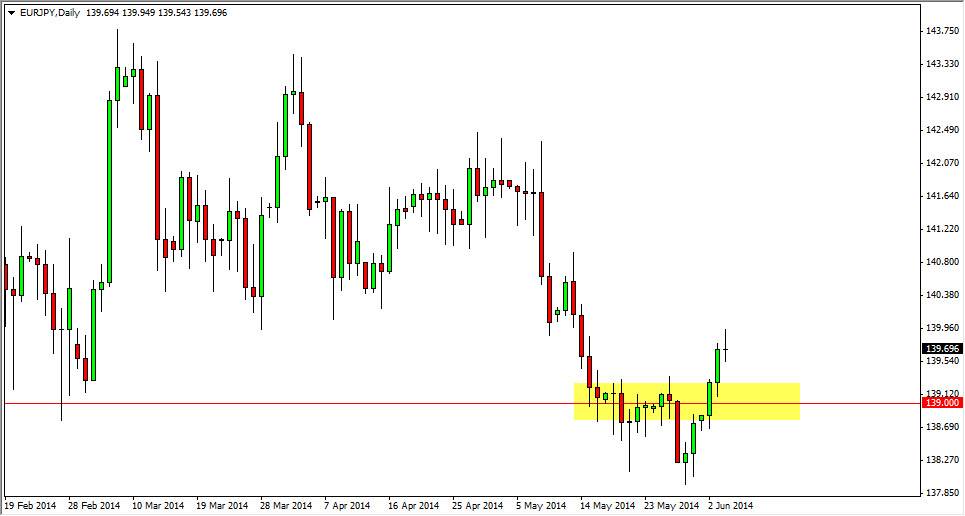

The EUR/JPY pair rose during most of the session on Wednesday, but as you can see ran into a bit of resistance of the 140 handle. The resulting action forced the printing of a shooting star during the day, which of course is a very negative candle. That negative candle to me suggests that we are going to get a little bit of a pullback. The real question then becomes how far

For me, I believe that the 139 level is an obvious candidate as it was once fairly supportive. Now that we’ve broken back above that area, why would need to happen again? The truth is that we should see a slight pullback, but that’s okay in my opinion as it should build more momentum for the Euro against the Japanese yen. After all, the Bank of Japan is working feverishly against the value of the Yen, and it is possible that the Europeans disappoint during the session today, and as a result the Euro gains due to lack of loosening monetary policy by the central bank. It’s a little counterintuitive, but at the move day to think about a long enough it makes sense.

I don’t like the Japanese yen anyway.

I am short of the Japanese yen against other currencies. The Turkish lira been one of my favorite right now, but at the end of the day I believe that the Japanese yen is going to struggle against most currencies if the central bank has its way in Tokyo. Ultimately, the Japanese economy needs a weak Yen, and they have a history of doing whatever they can to make that happen. With that, I think they will eventually get their way, and the Euro being as oversold as it is currently, I believe that this could be one of those perfect storms of sorts that allows the markets to go much higher. I think a pullback to the 139 level is very reasonable after this breakout, as it would give the market a chance to find buyers at a place where we once all significant resistance. Its classic technical analysis, therefore I like buying a supportive candle in that region.