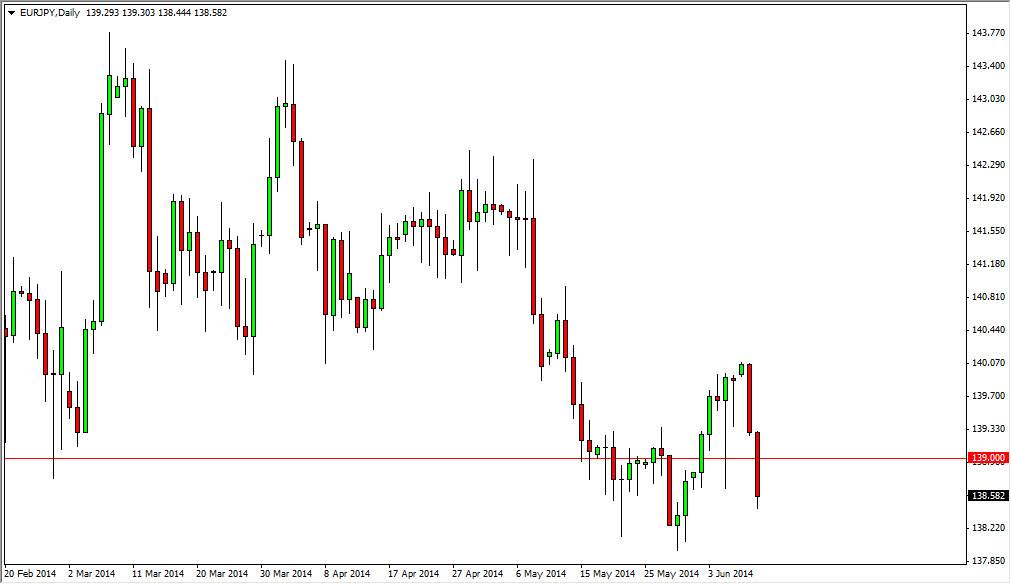

The EUR/JPY pair fell during the session on Tuesday, crashing through the 139 level. The 139 level of course has been ordered been resistive in the past, so it makes sense that this market will continue to gravitate towards this area. The fact that we fell during the day of course is very bearish, but at the end of the day we have not broken down below the bottom of the support area. The support area runs all the way down to the 138 level, so until we break down below that level on a daily close, I am not willing to sell this market. In fact, I think that this could be a nice buying opportunity if we get the right supportive candle.

The perfect supportive candle of course would be hammer, and I think that it could begin to be choppy in this general region. However, the choppy or it gets, the more likely this area is going to hold for support. If that happens, I expect that this market should go to the 142.50 level given enough time.

Watch the EUR/USD as well.

Watch the EUR/USD as well, as the value of the Euro will continue to be in focus, especially as the US dollar. If we break down below the 1.35 level in that market, this market will more than likely collapse as well. However, if the 1.35 level in the EUR/USD. Holds, I would expect this market to bounce from here, and rather significantly. After all, it’s the Japanese yen that we are trading against if we are buying the Euro in this market, and that is a currency the longer-term I think will be bearish.

This is a fight between 2 central banks that are both trying to loosen monetary policies going forward, and therefore I feel that it will continue to be choppy but I have to believe that the longer-term direction will be higher, as the Japanese yen will eventually get dumped, and that will be especially true if economic outlook around the world starts to pick up.