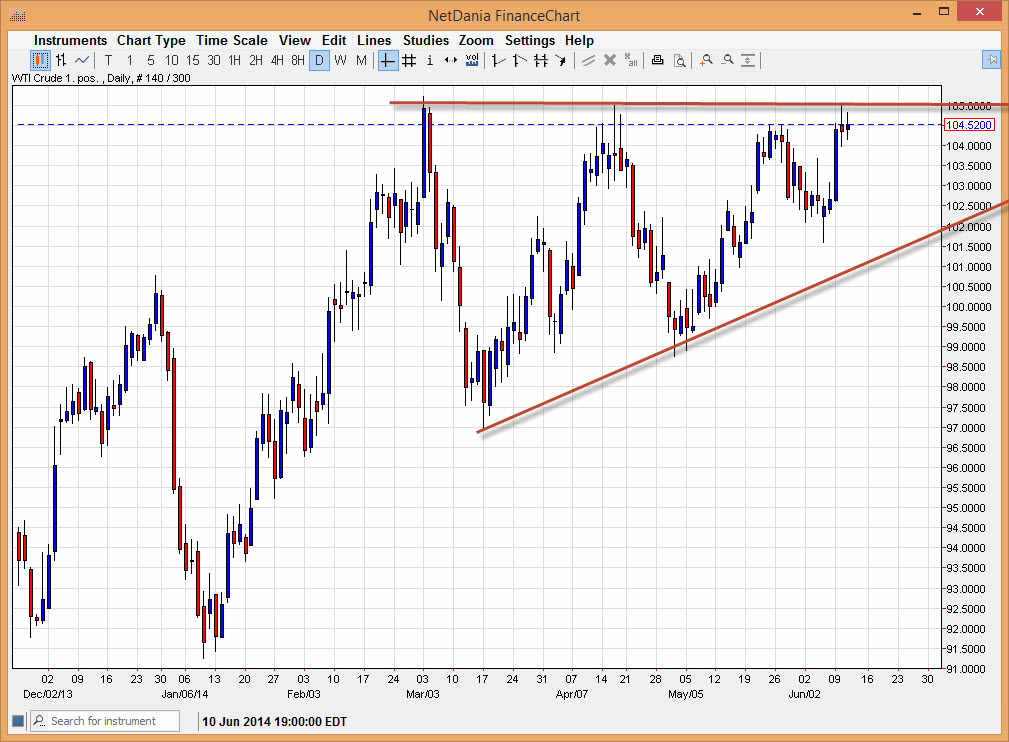

The WTI Crude Oil markets rose during the session on Wednesday, but just as we saw on Tuesday the sellers stepped in and kept the market somewhat down. The resulting candle is a shooting star which of course is negative, but I believe that we are simply trying to build up enough momentum and pressure to breakout to the upside. After all, there is a fairly obvious ascending triangle in this marketplace, and it’s only a matter of time before that upper level gets violated. If and when it does, this market should head to the $113 level based upon the measurements that are built into the triangle itself.

Any pullback will have to contend with the $102 level eventually, which I feel is far too supportive for the market to break through. If it did, that would of course change my opinion on everything, and more importantly violate the idea of the ascending triangle that my entire thesis is built on at the moment. However, I suspect that a move down there would probably turn this ascending triangle into some type of rectangle or something, meaning that we would more than likely head all the way down to the $99 level given enough time.

Ultimately, the oil markets look bullish in general.

One of the other markets that I will follow from time to time is the Brent market. Currently, it looks fairly bullish as well, albeit from more of a choppy situation. Nonetheless, I feel that oil markets in general are going to rise over the course of the summer, and good economic news out of the United States certainly will do nothing to deter the idea of there being demand in the light sweet crude sector. I think ultimately this market will outperform the Brent market, as there should be more demand in North America anyway. We are getting closer to the breakout, and any move above the $105 level that stays above there for more than a couple of hours is going to be good enough for me to start buying this market.