The CHF/JPY pair it is a market that I pay attention to quite frequently. Certainly trading the Japanese yen in general, this is a good barometer as to where the “scared money” is starting to run to. Both of these are considered to be “safety currencies”, and as a result this can show you in fairly clear terms as to where money is flowing around the world. With that being said, it appears that the Swiss franc may get a little bit of a boost as the Japanese yen sells off.

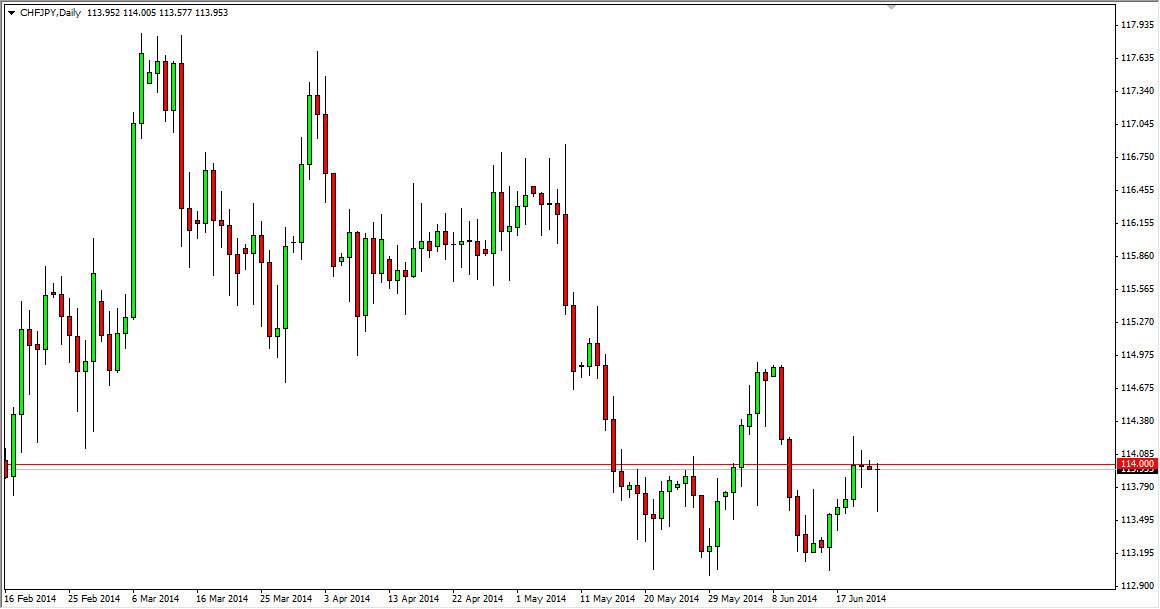

The fact that we try to sell off during the session on Monday wasn’t necessarily a surprise, as the 114 level has been an area of interest before. However, we bounced quite a bit to form a hammer and a relatively unchanged candle. With that, it appears that the buyers are starting to step in in strength, and a move back above the 114 level would be enough to get me to start buying this market. I think that we will ultimately target the 115 level over the course of the next couple of days, an area that should have a psychological impact due to the big round figure. However, I think ultimately this market will break above there as well.

Longer-term, we still appear to be in a bit of an uptrend.

I believe that we are still in an uptrend longer-term, and this is partially because unlike the Bank of Japan, the Swiss National Bank has actually taken direct intervention to the Forex markets to devalue the Franc. Typically, they worry about the value of the Franc against the Euro, but that does have a bit of a “knock on effect” in the Forex markets. With that being the case, and looking at other yen related pairs, I feel that the Japanese yen will more than likely be sold off of the next several sessions, and this of course should be seen in this pair as well. I think 115 will be a bit of a barrier, but ultimately the upward momentum should prevail. I have no interest in selling this market right now.