By: Ben Myers

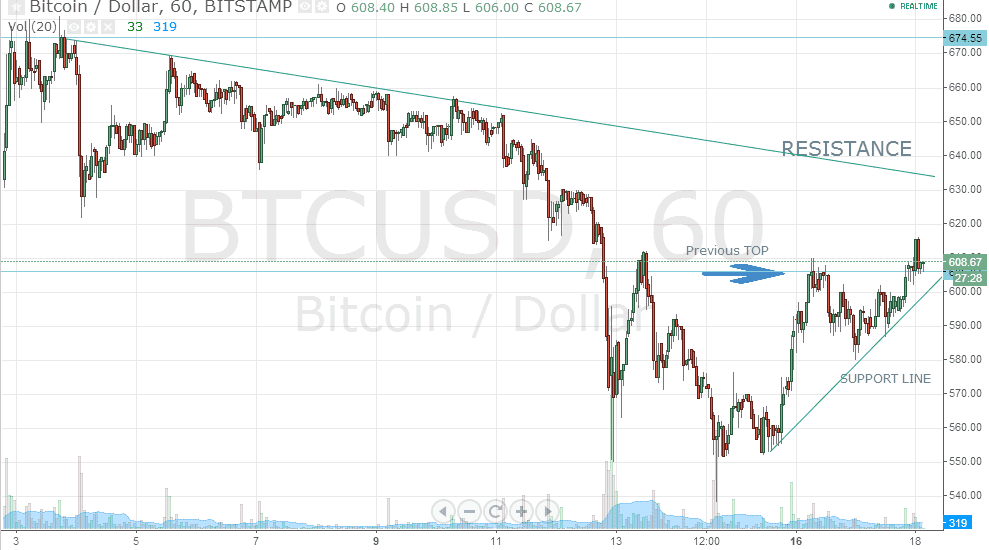

As can be seen from the hourly price chart, the BTC/USD which had been consolidating around 600 for quite some time, has been able to take out its previous top near 605 and is sustaining above it. BTC/USD has entered into an upward trend on the back of the support line (as seen in the chart) and its sustenance above the previous top is a clear indicator of a price reversal and more gains in the coming sessions. The pair already appreciated 10% from the lows of around 550 to 600+ levels in approximately two trading sessions. A major development that supports this upmove is the approval of the Chapter 15 US bankruptcy filing by the failed Bitcoin exchange Mt. Gox. This move shifts the proceedings to the Japanese courts and empowers the exchange’s Japanese bankruptcy trustee Nobuaki Kobayashi to “exert more influence and vet any revival plans.”

Fresh long positions can be created now and on declines up to 600 for targets near 630 where a major resistance lies (marked in the above chart). The stop-loss for the long positions can be placed around 600-598 maintaining lucrative profit-to-loss ratios. It must be noted that all long positions must be squared-off near the resistance line and only a significant close above this will set the stage for further gains with stronger momentum.

Traders may also short near 630 for targets of 615-610 with a stop-loss placed at around 635 for profit-to-loss ratios of a minimum of 3:1.

To cash in to the rising interest in the use of Bitcoins and other cryptocurrencies, a new association with the sole purpose of promoting the use of Bitcoin has been formed in Singapore.

The Association of Crypto-Currency Enterprises and Start-ups, Singapore (ACCESS), will represent various businesses such as exchanges, merchant transaction services, vending machines and miners and adds further credibility to the digital currency which boosts its value.