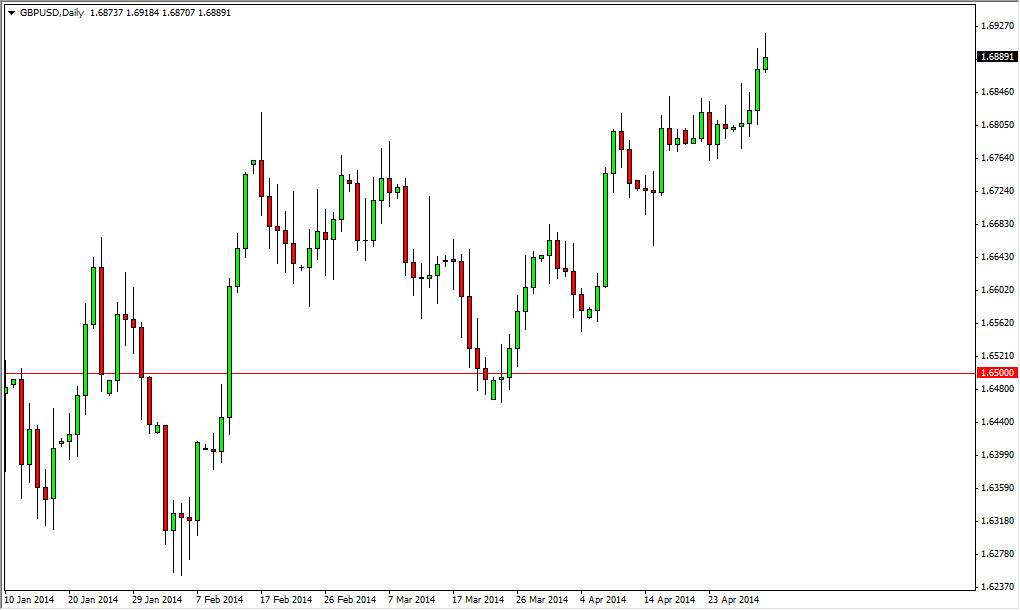

The GBP/USD pair tried to rally during the bulk of the session on Thursday, but as we approached the 1.69 level, sellers came back into the marketplace to push the British pound back down. Because of this, the market ended up forming a shooting star, which of course is a very negative sign. However, the fact is that the market is very bullish, and as a result I don’t look at this is a market that I want to start selling. In fact, I believe that the market is one that you should be waiting to see some type of supportive move lower. Obviously, a break down from here could find plenty of support, especially at the 1.68 handle.

With that, I am more than willing to go long on a pullback that shows the signs of support, or break above the top of the shooting star. I believe that the 1.70 level is where we are going given enough time, but with the nonfarm payroll announcement coming out later today, the could be quite a bit of volatility.

Nonfarm volatility could lead to clarity.

The volatility coming out during the session today will more than likely give us some clarity on not necessarily the direction of this pair, but when to enter it. That is a subtle, yet key difference. After all, the market is obviously in an uptrend, and unless there’s some kind of massive shock to the system after the announcement, I don’t think that anything is going to change. I would look at some type of selloff in this market as a potential buying opportunity.

On the other hand, if we break the top of the shooting star right away, then that would be a very bullish sign as we could probably at the 1.70 level without too many issues. A break above the 1.70 level will happen given enough time, but it is a large, round, psychologically significant number on the higher timeframe charts. I see absolutely no reason to sell this pair at all at the moment.