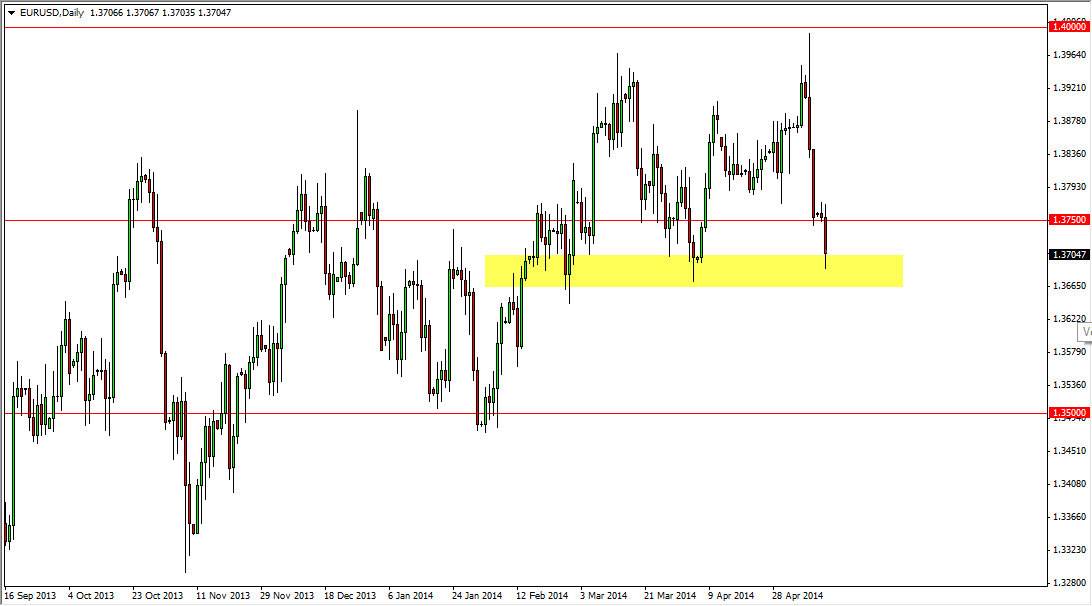

The EUR/USD pair fell hard during the session on Tuesday, testing the 1.37 level. The 1.37 level did in fact told support though, and as a result it has caught my attention. This is one of those situations where I am not going to enter the market right now, but this very well could be a point of inflection that could make a massive difference in the outcome of what this pair does for the next several months.

This area is an area that has to hold if the Euro wants to continue to have some kind of strength. Quite frankly, we have sold off rather hard over the last several sessions, and I cannot help but wonder if it hasn’t been a bit overdone. After all, just because the European Central Bank doesn’t like the market sending the Euro higher doesn’t mean that the markets going to pay attention. Also, the fact that we have dropped 3 handles in the last couple of sessions is a bit excessive.

Several different reasons.

There are several different reasons the think that this market is about to make a serious decision. On one hand, there is the potential for a trend line being tested during the session today, and that should function as major support. On top of that, the 1.37 level should be supportive as it has been several times in the past.

The consolidation area of that we could be heading towards in the summer could become between the 1.37 level and the 1.40 level if we bounce from here. On a supportive candle, I think that this market could very well try to go back to that level, but it’s not going to be an easy move. This could be the range that the market falls into over the course of the summer. After all, we are getting fairly close to the time that the market tends to go sideways. On the other hand, if we break down from here, I could see this market falling all the way to the 1.35 level. Either way, the real analysis will begin in 24 hours as far as I can tell.