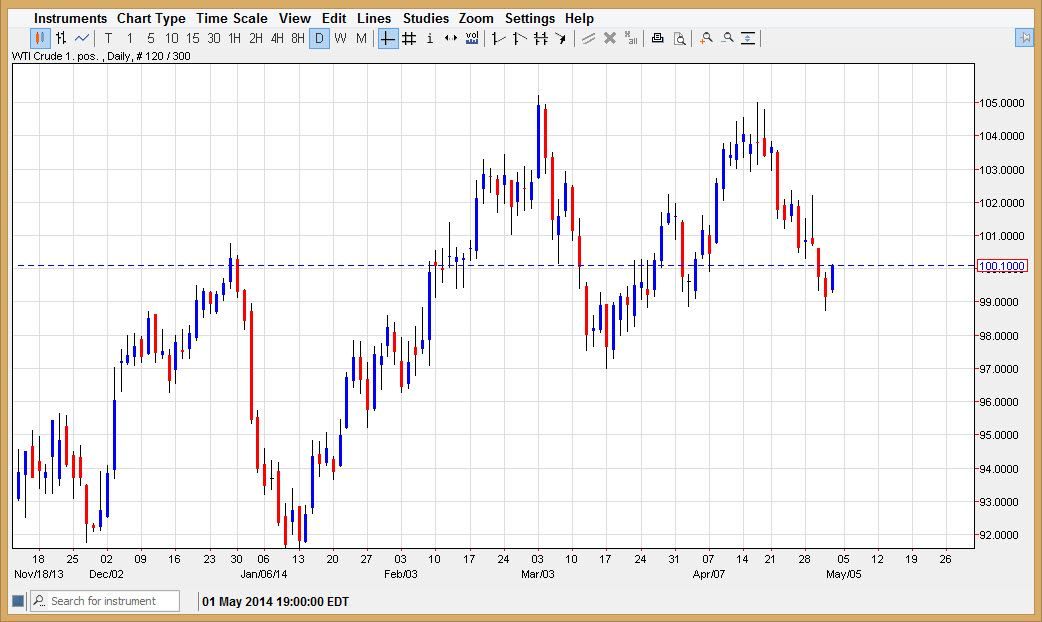

The WTI Crude Oil markets rose during the session on Friday, breaking above the $100 level by the time the session closed. Because of this it appears that the market is ready to go higher, and I recognize that a move above the $100 level is in fact significant. With that, I am a buyer this market but I recognize that the $102 level could be resistive as well. I ultimately believe that the market is bullish, but there will be fits and starts along the way.

Adding to that, there are concerns about the Russians and any potential sanctions on oil markets. With that, there is going to be an underlying pressure to the upside in this marketplace anyway, and therefore it makes it very difficult to sell. Because of this, I feel that the market is essentially just waiting on some type of headlines across the newswires in order to shoot higher.

I think that short-term traders will do well.

I believe that ultimately this will be a short-term trader’s type of market for the meantime. It will have an upward bias, and as a result I would be focusing on pullbacks on short-term charts. Ultimately though, I do think that the market goes back to the $105 level where will find significant amount of resistance. If we can get above that level, I see no reason whatsoever why the market won’t head to the $110 level, given enough time. Because of this, I am “buy only”, and would not consider selling this market until we get below the area that I figure is massive support, the $97 handle.

A move below the $97 handle would in fact be very bearish for this market, and probably send it crashing down towards the $92 level with a potential pickup at the $95 handle. I don’t think that’s going to happen though, as I believe that there are plenty of reasons to recognize this is a market that does not want to fall. Going forward, I suspect that buying longer-term calls will possibly create a nice opportunity as well.