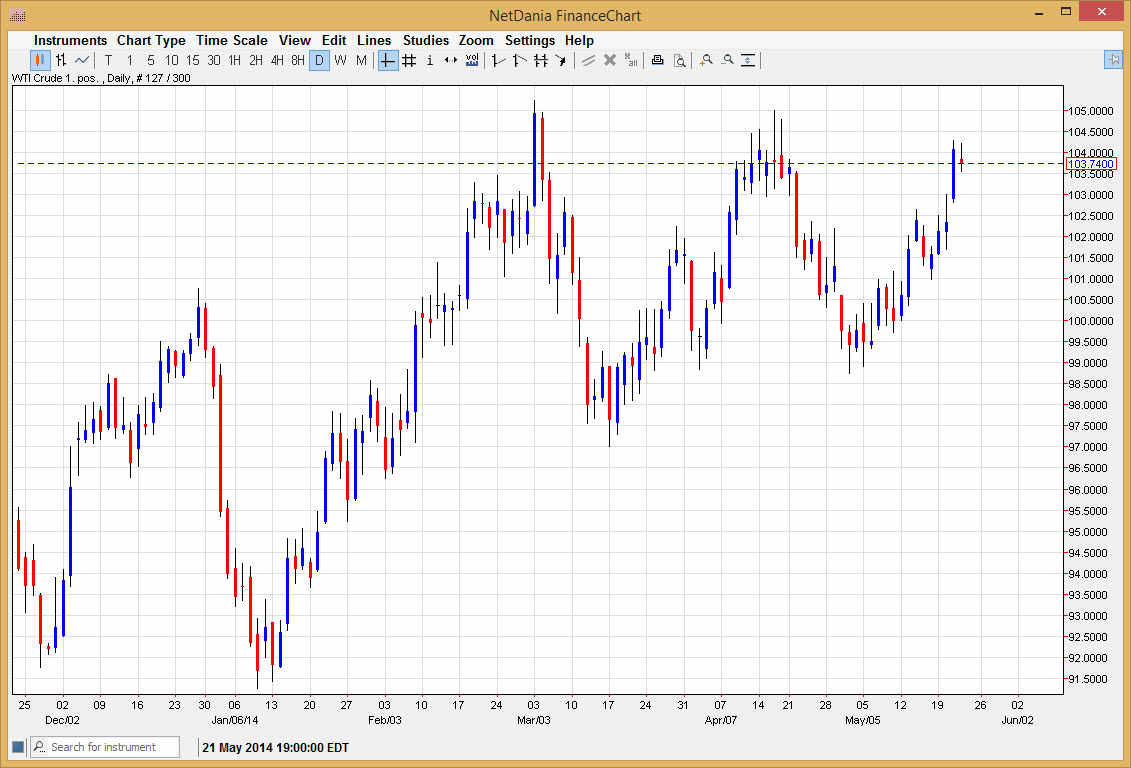

The WTI Crude Oil markets had a negative session on Thursday, testing the resilience of the buyers in this market. The results are in, and we certainly have enough support below to keep this market afloat in my opinion. I think that the $105 level is a major breakout point, and if we can get above that area I see no reason why we will continue to the $110 level given enough time. On a daily close above the $105 level, I am now in “buy and hold” territory, and would be very aggressive as far as being long.

There is the possibility that we may have a fall from time to time, but truthfully those pullbacks should be buying opportunities as there is so much in the way of support below. With that, I feel that the market should continue to go higher, and based upon the potential ascending triangle that we see on this chart now, I believe that this market could go as high as $112.

Headlines could abound as well.

Keep in mind that there are still concerns with Russia, and that of course can move the oil markets. On top of that, there is the possibility that the US dollar weakens a little bit, but at the end of the day I think that it’s probably geopolitical concerns that will come into play more than anything else at the moment. There is a certain amount of demand out there right now too, and the pullback on inventories in the United States showed that this week. With that being the case, there is demand as well as the summer driving season starting this weekend in North America, that of course causing markets to go higher as well as the judicially will do. However, we will eventually settle into a summer range of sorts typically, so I think that we are about to see the breakout to the upside, and then we will just kind of meander our way up to the $112 level, unless of course things erupt in the Ukrainian situation, which of course would send prices through the roof.