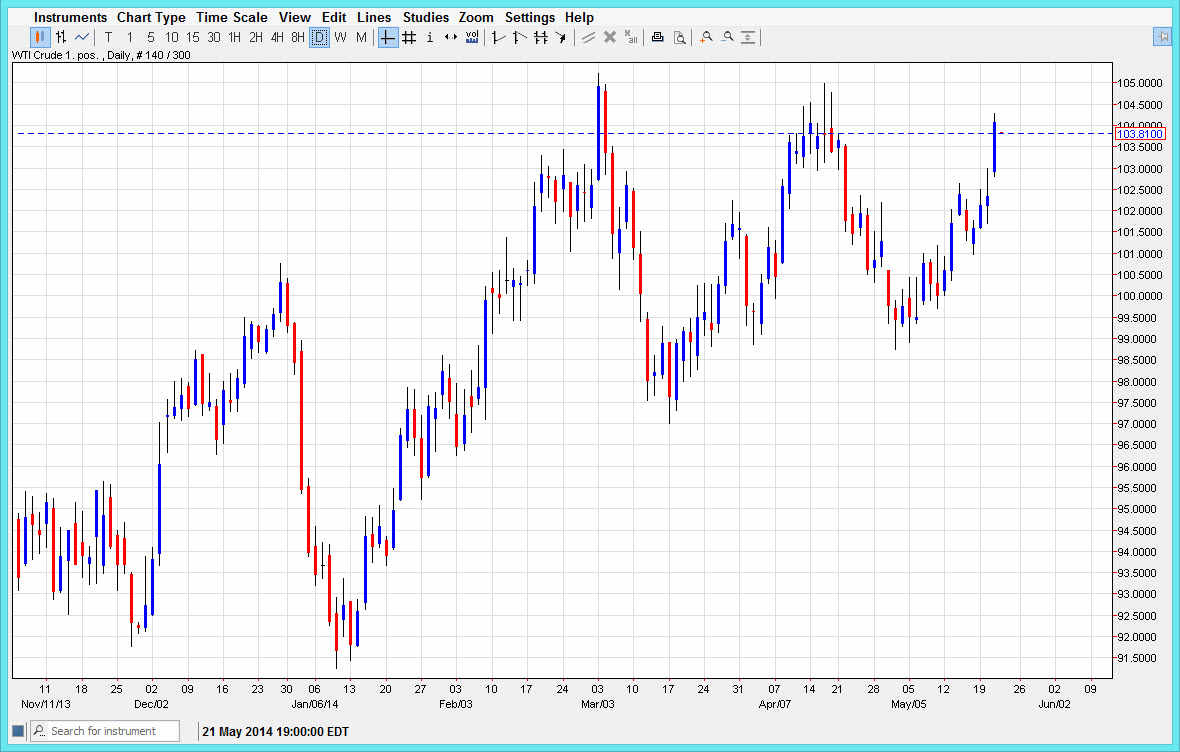

The WTI Crude Oil markets gapped at the open on Wednesday, clearing the $103 level and extending the move to the $104 level. With that, it appears that we are going to press up against the $105 level given enough time, and then probably breakout. Any pullback at this point time would be a buying opportunities far as I can tell, especially considering we now have that gap which is centered around the $103 level, an area that has both been resistance and support in the past. In other words, there are a lot of traders interested in that area.

I believe that a break above the $105 level is in fact coming, and as soon as we get that we should continue on to the $110 level. That being the case, the market appears that it is going to be rather bullish, and therefore any pullback at this point time for me is simply a momentum building exercise.

Plenty of headlines out there.

With inventories came back in the United States, and reports that Russian soldiers are still on the border with the Ukraine, it’s hard for me to believe that the oil markets will continue to be bullish overall. Because of this, I feel that there’s no way to short this market, at least not until the economic situation as well as the geopolitical situation both change. Until that happens, I am a “buy only” mode.

I think that a pullback from here is going to find plenty of support at the $103 level, the $101 level, and the $99 level, followed by the $97 level. In fact, it really isn’t until we get below the $97 level that I can even fathom shorting this market with any type of comfort. I think that most of the market probably feels the same way, and there is still the possibility of and ascending triangle being formed at this moment. With all those things above, it’s really difficult for me thinking anything more than that this market is going to go much, much higher over the course of the summer.