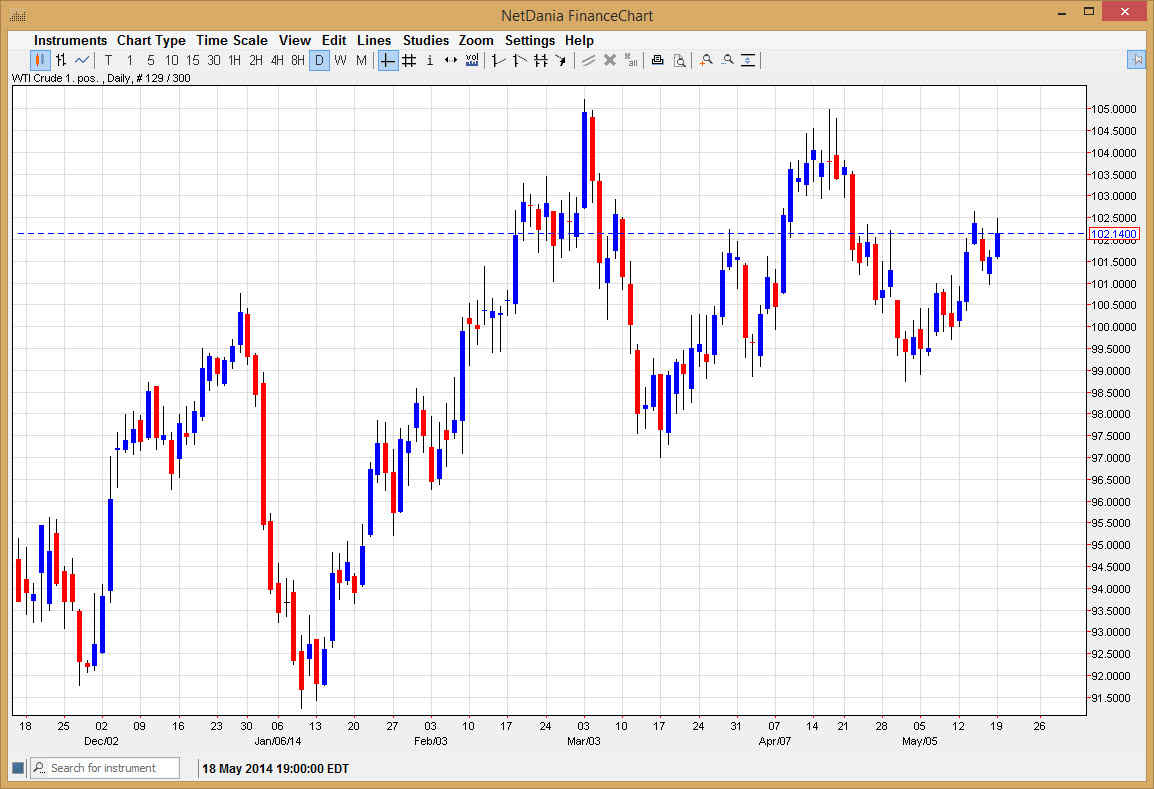

The WTI Crude Oil markets rose during the session during Monday, and as a result the markets look as if they are getting ready to continue higher. The market has been somewhat bullish to begin with, and because of that – I am “long only.” Because of this, I am looking for short-term pullbacks to get involved in this market. I believe that we will ultimately charts towards the $105 level, but it will probably take quite a bit of back and forth type of trading. It will more than likely be choppy, but ultimately I believe that this market does in fact go higher given enough time, and there is the possibility that we are trying to form some type of ascending triangle.

The potential ascending triangle has resistance of the $105 level, extending the shape all the way down to the $97 handle. If that’s the case, and it does end up being true, that would have the market aiming for $112 based upon the shape of the triangle.

Far too many reasons to go higher.

I personally believe that this market has far too many reasons to go higher, and headlines will more than likely favor higher oil prices regardless. The US dollar is in exactly burning up the Forex markets right now, and on top of that we do have all of the issues in the Ukraine. Remember, Russia is a major exporter of oil, and although they do not export WTI grade crude, it will have a bit of a “knock on effect” in this market as Russian uncertainty continues. With that, I believe that there’s far too many potential reasons to go higher, and with that the markets will eventually breakout to the upside.

Going forward, I feel that this market will ultimately break above the $105 level and head at least to the $110 level. And on short-term pullbacks will be very buyable as there certainly is no real argument to short this market. I believe that will be the case for the foreseeable future at this point in time.