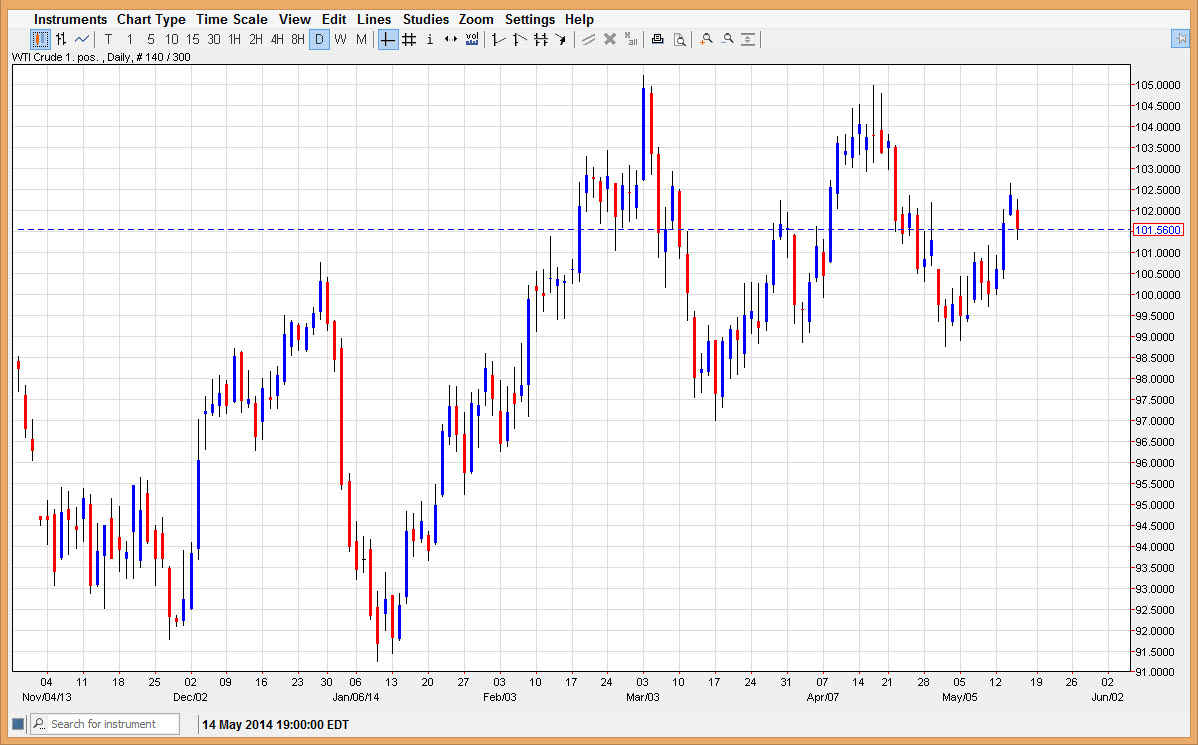

The WTI Crude Oil markets tried to rally initially during the session on Thursday, but as you can see the $102 level offered far too much in the way of resistance, thereby pushing the market back down to the $101.50 area. With that, the $101 level is the next target, going down to the $100 level, and then ultimately the $99 level. Because of that last statement, I am certainly not interested in shorting this market at the moment, as there is so many areas that support could come back into the marketplace.

Because of this, I feel that the market will more than likely continue to go higher eventually, but it could be a bit of a choppy ride higher. If you look at the overall structure of the chart, you can see that we are possibly trying to make some type of ascending triangle, with resistance at the $105 handle.

This is a buy only market as far as I can see.

Because of the potentially ascending triangle, I see no reason whatsoever to start selling. In fact, I think that the issue that Russia is having in the Ukraine suggests that oil markets should continue to go higher. Granted, the WTI grade doesn’t come out of Russia, but at the end of the day if sanctions do get thrown on the Russians, oil markets in general will rise in this will be a bit of a “knock on effect” in the WTI markets as distillers will look to reduce petroleum from other great of oil.

Regardless, I think that there is also the possibility that the US dollar will drop in value in the near-term, and that could of course pushes market higher as well. After all, this is a commodity that is based in those same Dollars, and as the value of those Dollars decrease, then it will take more of them to buy WTI Crude Oil. In general, it’s not until we break well below the $97 level on a daily candle that I can even fathom shorting this market for any length of time.