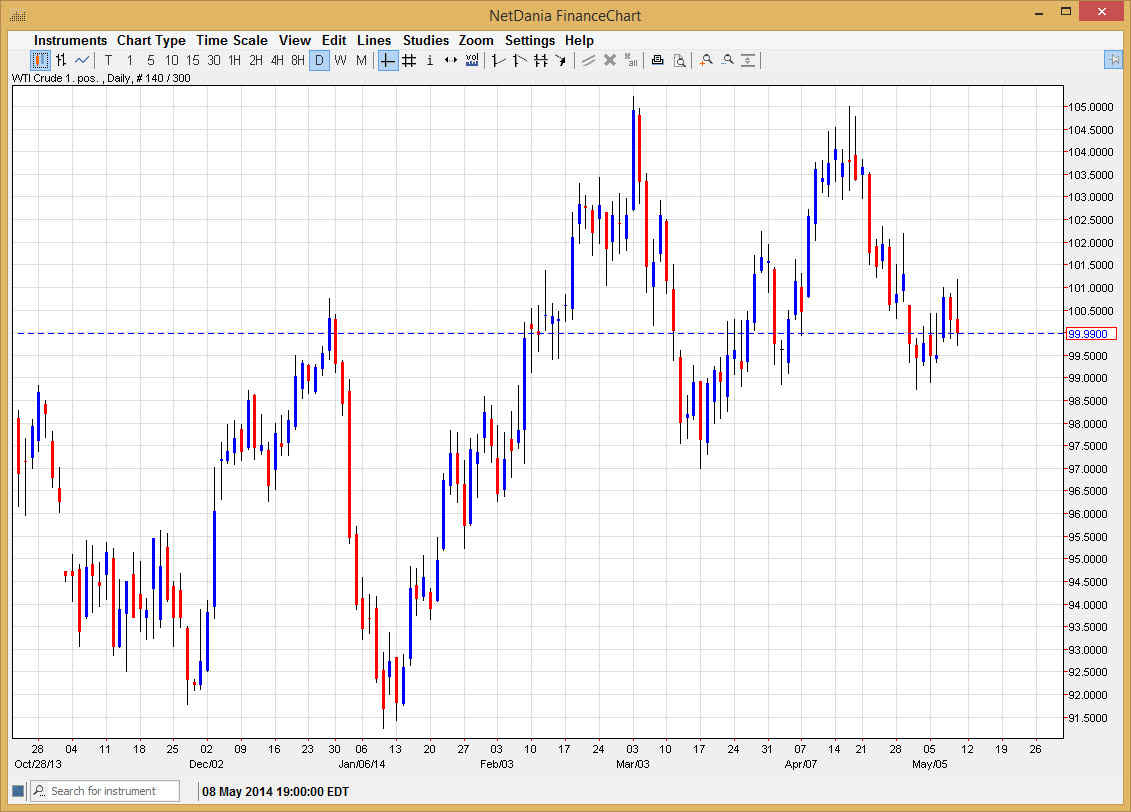

The WTI Crude Oil markets rose during the majority of the session on Friday, but found the $101 level to be far too resistive. Because of this, the market turned back around and formed a shooting star as we fell back down. That being the case, it appears that the market is struggling to continue going higher, but I still believe that there is plenty of support just below, especially around the $99 level. With that, I am simply waiting for some type of supportive candle in order to start buying again. Alternately, I would start buying on a break above the top of the shooting star from Friday, as it shows a significant boost to positive momentum.

Below there, I see a significant amount of support down at $97 level as well, so even a break down from here doesn’t get me too interested in shorting. I think that this market will ultimately go much higher, but it is possible that we drop down to the $97 level, insomuch as to find a bottom to the potential consolidation area.

Summertime.

We are starting to get relatively close to the summertime, so I’m starting to wonder whether or not we aren’t simply trying to form some type of consolidation area for that season. After all, quite often the summertime gets to be very quiet in the futures markets, with oil being no exception. Because of that, I’m paying a lot of attention to the $97 level on the bottom, and the $105 level on the top. It’s very possible that the market just bounces around in that general vicinity trying to find some type of clarity. With the lack of liquidity that we often see in the summertime, I believe that this is probably most likely with going to happen over the next several months.

However, in the meantime we could see short-term moves, and I’m willing to take advantage of them. Regardless, I have more of an upside bias then down, so I’m looking for supportive candles on the daily or even lower timeframe charts in order to get involved.