USD/JPY Signal Update

Yesterday’s signal was not triggered and expired as the price never reached 103.00.

Today’s USD/JPY Signal

Risk 0.50%

Entries may be made either before 5pm today New York time, or between 8am Tokyo time and 8am London time tomorrow (Thursday).

Short Trade 1

Go short following confirming bearish price action on the H1 chart after a first touch of 103.00.

Put a stop loss 1 pip above the local swing high.

Adjust the stop loss to break even when the price reaches 102.75.

Take off 25% of the position as profit at 102.75, then 50% of the original position size at 102.50, and then leave the remainder of the position to run.

Long Trade 1

Go long following confirming bullish price action on the H1 chart after a first touch of 101.91.

Place a stop loss 1 pip below the local swing low.

Move the stop loss to break even when the price reaches 102.27.

Remove 25% of the position as profit at 102.27, then 50% of the original position size at 102.50, and then leave the remainder of the position to run.

Long Trade 2

Go long following confirming bullish price action on the H1 chart after a first touch of the long-term bullish trend line currently at around 101.34.

Place a stop loss 1 pip below the local swing low.

Move the stop loss to break even when the price reaches 101.83.

Remove 25% of the position as profit at 101.83, then 50% of the original position size at 102.50, and then leave the remainder of the position to run.

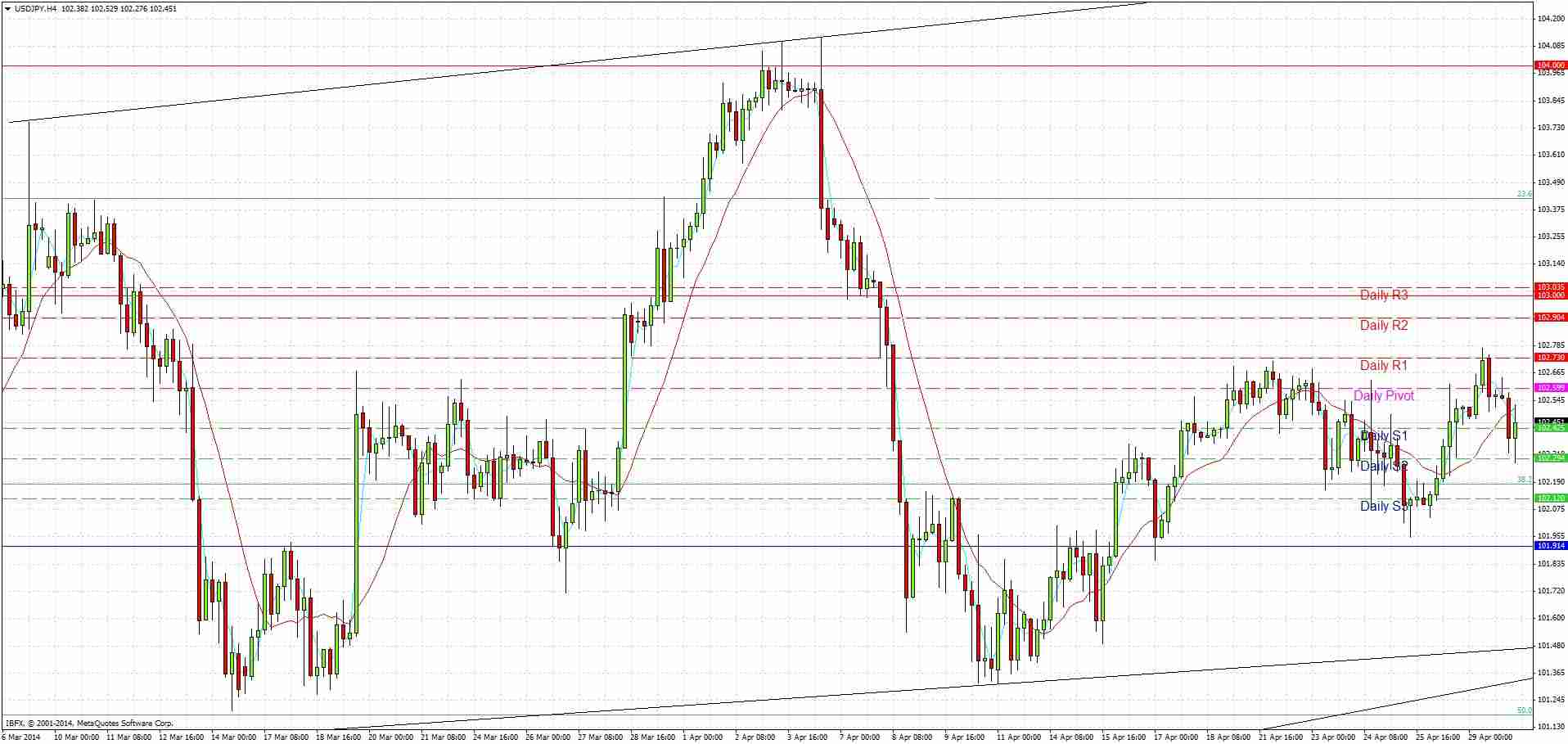

USD/JPY Analysis

As forecast yesterday morning, the action yesterday was initially bullish and we did reach 102.75 which is a significant swing high. However we then went on to print a bearish pin bar on the daily chart as the price fell and was unable to get beyond the 102.75 level.

The support level at 101.91 is ready to come into play again today although we are still some way away from it. We are still in a slight and bouncy long-term upwards trend so my bias is bullish overall. We have a very long-term trend line below us at 101.34 which is likely to be very supportive if we get there. We also have an inner bullish trend line above that at around 101.48 and we might well also get some support there: my colleague Christopher Lewis also mentions this level as support.

Above us there is resistance at 103.00 and also at 104.00. Both of these are of course nicely confluent with round numbers.

I am not as long as my colleague Christopher Lewis and I am ready to look for short trades in the right circumstances.

There is no high-impact news due today for the JPY. Regarding the USD, at 10am London time there is the Eurostat CPI Flash Estimate. Later at 1:15pm there is the ADP Non-Farm Employment Change data, followed by Advance GDP 15 minutes later. Finally at 7pm there is the FOMC Statement. It is likely to be a fairly active day, at least in the sense of choppiness, but it may take the FOMC Statement to produce any real directional movement.