USD/JPY Signal Update

Yesterday’s signal expired without being triggered.

Today’s USD/JPY Signal

Risk 0.50%

Entry may be made before 5pm London time today, and then during the Tokyo session until 8am London time tomorrow morning.

Long Trade 1

Enter long with a limit buy order at 102.97.

Stop loss at 102.45.

Move the stop loss to break even when the trade is 20 pips in profit.

Take off 50% of the position as profit at 103.45. Leave the rest of the position to run and exit it at 103.95.

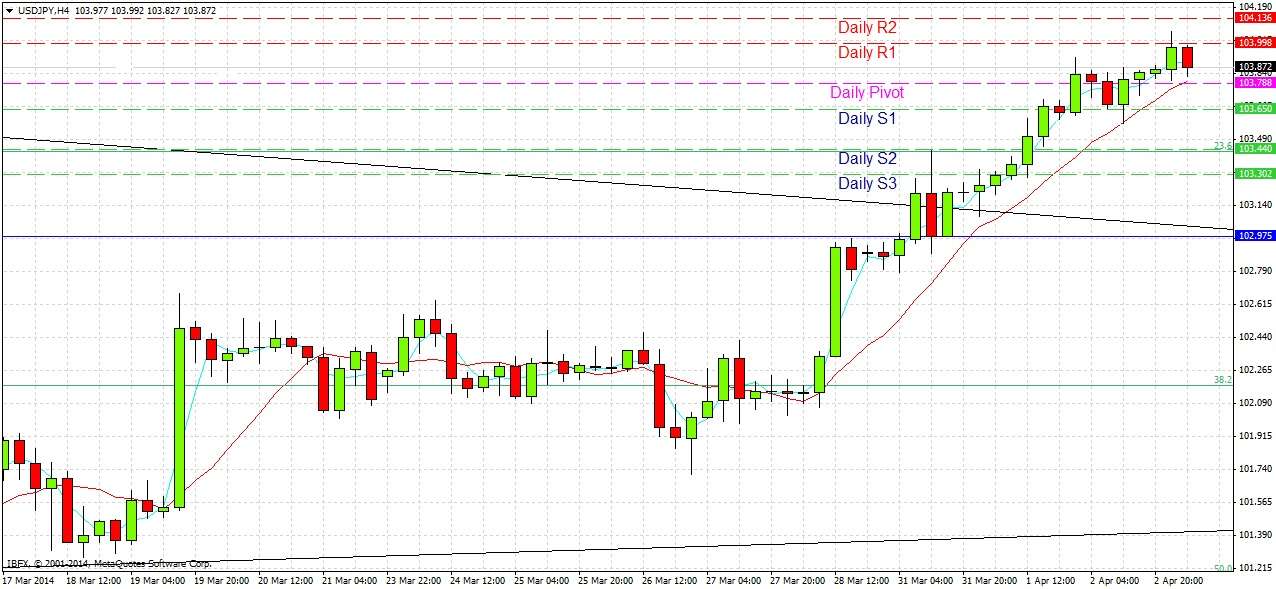

USD/JPY Analysis

We have broken up through the triangle, and the pair has continued to act bullishly, making a higher high and low yesterday. We have also broken a recent high but the price overnight has shown reluctance to move much above the 104.00 area.

There is a multi-year high ahead of us at around 105.50, where there was recently heavy selling, so it is probable that there is not much more short-term upside left. However the price action is still very bullish and this strong upwards trend seems quite resilient.

Given these facts and the lack of any really good resistance levels ahead of us, it makes sense to keep a long bias and look for a new long position where we can. Although we are some way away from the 103.00 area, it looks like a great place to go long as it is currently confluent with resistance turned into support and a retest of the broken bearish trend line from the recent triangle. The logical target for at least part of the position would be the recent swing high and round number confluence at 104.00.

There may also be a good support coming in at the daily S2 pivot point at 103.45, where there is also a minor resistance turned into support level.

There are no high-impact news releases expected today for the JPY. Later on there is a slew of US-related high-impact data. The USD data releases are the Trade Balance and Unemployment Claims statistics at 1:30pm, followed by the ISM Non-Manufacturing PMI at 3pm. The pair is likely to be quiet until this time when it should turn volatile.