USD/JPY Signal Update

Monday’s signals were not triggered and expired.

Today’s USD/JPY Signal

Risk 0.50%

Entries must be made before 8am tomorrow (Thursday) London time.

Long Trade 1

A long trade is possible with a buy limit order at the first touch of the 100.88 level.

Put the stop loss at 100.38.

Move the stop loss to break even when the price reaches 101.27.

Take 75% of the position as profit at 101.27 and leave the remainder of the position to ride.

Short Trade 1

A short trade is possible following confirming bearish price action on the H1 chart following a first touch of 103.00.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even when the price reaches 102.57.

Take 50% of the position as profit at 102.57 and half of the remainder after that at 102.05. Then leave the remainder of the position to ride.

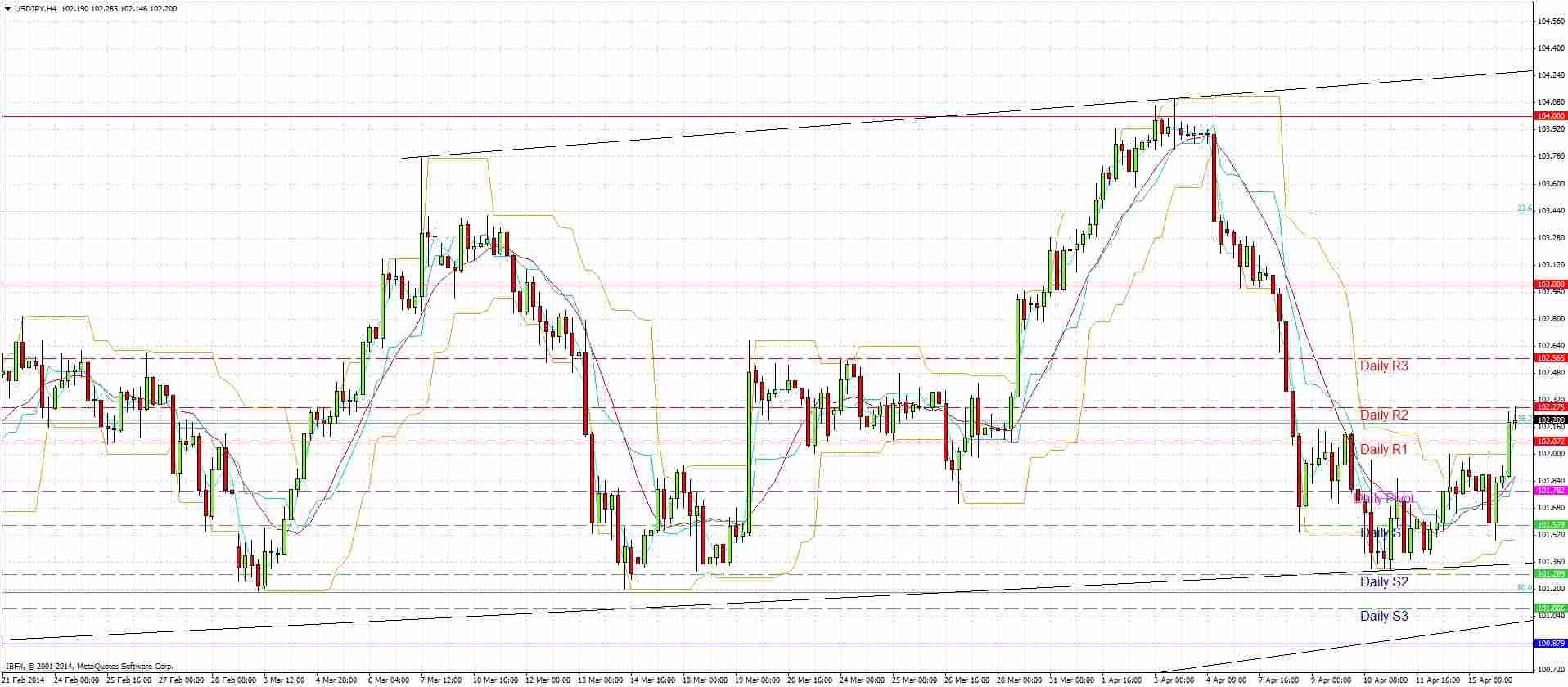

USD/JPY Analysis

This pair is in a fairly mixed-up situation. A candlestick analysis of the higher time frames shows the monthly time frame looking bullish, the weekly bearish, and the daily bullish. The pair was looking heavy but was unable to break down below the 101.00 area and has begun heading upwards again.

It is very difficult to predict what will happen next and the major trend lines really now have to be revised to show we are within a very wide, slightly bullish ranging channel.

We should see some volatility today and due to the ranging nature of the pair I am very comfortable looking for a short at 103.00 and a long at 100.88. There is a very long-term bullish trend line at 101.00 right now which should give good impetus to any long at 100.88.

At 1:30pm London time there is a release of US Building Permits data. The Chair of the Federal Reserve is speaking just after the London close at 5:15pm. Later at 1:30pm London time the Governor of the Bank of Japan will be speaking. Therefore we have a few events due before 8am London time tomorrow that could trigger volatility in this pair, particularly the two later events.