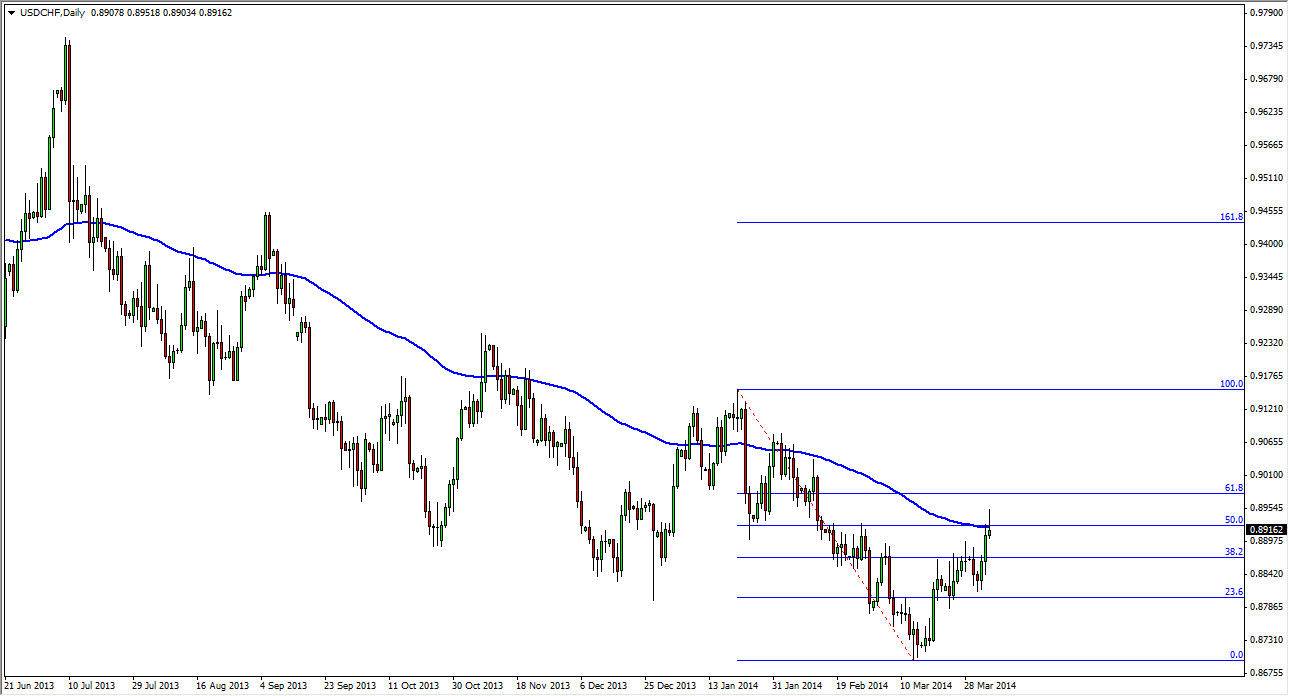

The USD/CHF pair tried to rally during the session on Friday, but as you can see failed to hang onto the gains. Because of this, the market turn things back around and formed a shooting star. The shooting star is focused on the 0.89 handle, and as it is sitting just on top of that level I believe that the market is probably ready to start pulling back again. I see a “zone” of resistance from the 0.89 handle to the 0.90 handle, so with that being the case it wouldn’t surprise me at all to see this market selloff here.

On top of that, we happened to find resistance right at the 50% Fibonacci retracement level of the latest move lower, and found the 100 day exponential moving average to be resistive as well. With all that being the case, I think that this is a trade that is probably setting up to be fairly profitable to the downside.

Confluence of events.

These are my favorite trades, when there are several different reasons to be involved. This chart looks just about as perfect as it could, and as a result I will not hesitate to start selling. After all, on top of all of the factors mentioned above, the trend is most certainly to the downside as well. Because of this, I feel that the “safe bet” is shorting this pair.

I see that the 0.8850 level below is probably going to be somewhat supportive, but overall the market looks as if it is ready to continue the downward trend given enough time. With that, I would suspect the market likely to fall the way back down to the 0.87 handle, and probably lower given enough time. I find no reason to buy this market at all, since there is so much in the way of noise all the way up to the 0.9150 level. With that, I am in “sell only” mode at the moment, and fully anticipate that the trend should continue going forward, unless of course the Swiss National Bank decides to get involved in the currency markets again, which seems very unlikely at the moment.