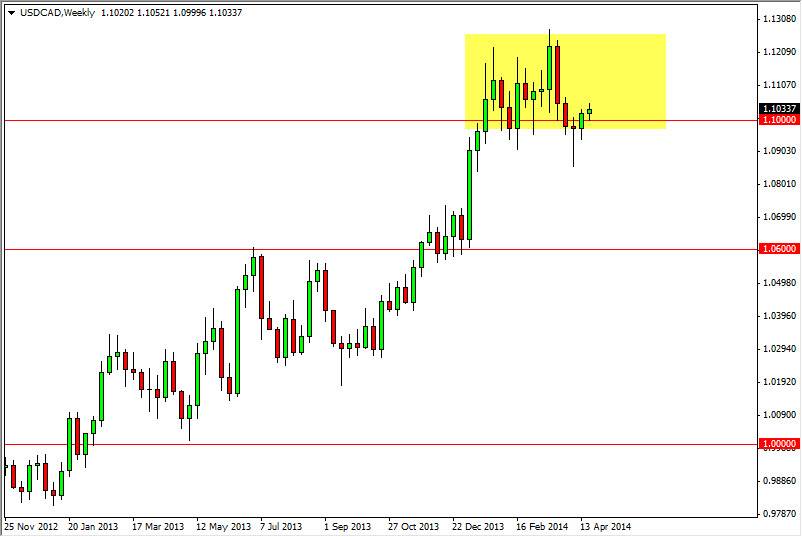

The USD/CAD pair rose during the bulk of the back half of April. Because of this, we have broken above the top of the hammer from a couple of weeks ago, and fired off buy signals. As far as I’m concerned, I think that this market does continue to consolidate, and I fully anticipate the market bouncing up towards the 1.13 level. This would be simple consolidation overall, and a return to the norms so to speak.

The 1.13 level will of course be resistive as it has been in the past, but ultimately I believe that the market will go through that level, and march towards the 1.15 level, an area that I’ve had as a longer-term target for some time now. We look at this chart, you can certainly see that there has been an impulsive move, followed by a grind sideways, which is often the market catching its breath before it goes higher.

Canadian dollar and oil.

The Canadian dollar and light sweet crude markets tend to run hand-in-hand most of the time. This makes sense of course because of the amount of crude oil that the Canadians export to the United States. What I find interesting is that recently we have seen the Canadian dollar weaken while the oil markets have gained.

Going forward, I would anticipate that every time this market falls, it will be a buying opportunity. That should be the way this market works for the month of May, and quite frankly probably longer than that. With that, I am very bullish, and I have absolutely no interest in selling this market. Even if we pull back from here, I suspect that the 1.06 level is going to be massively supportive and should attract a lot of buyers.

It really isn’t until we close below the 1.05 level and him comfortable selling, and as a result I’m going to be buying this pair several times over the course of the month. Once we get to the 1.15 level, that area could be rather resistive, so we will have to cross that bridge when we get to it.