Gold gave up some of its earlier gains against the American dollar during Thursday's session but as you can see the market is still trapped within the last four days' trading range. Market participants are understandably in a more cautious mode ahead of highly anticipated U.S. jobs data. It seems that lack of geopolitical tensions coupled with uncertainty over whether the U.S. Federal Reserve will begin to raise interest rates next year will keep investors sidelined for a while.

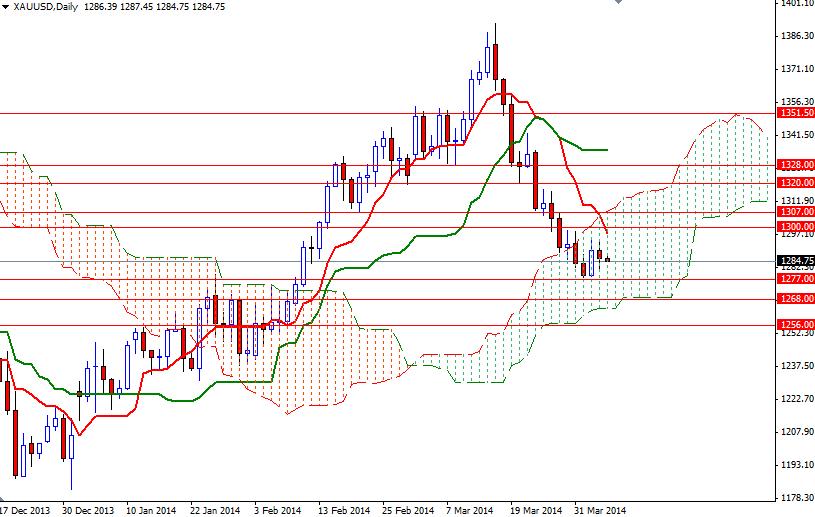

The XAU/USD pair has been consolidating in a relatively tight range since prices entered the Ichimoku cloud on the daily chart but of course this was what I expected to see. Gold prices are oscillating around the 1289 level while the 1300 and 1277 levels contain the market and because of that it will be hard to build a long-term position. With this in mind, I think it makes more sense to wait until we break out of this consolidation box and depart from the clouds (daily chart).

From an intra-day trading perspective, breaking above 1300 could signal a run up to 1307 or higher. Beyond this barrier, there will be hurdles on the way such as 1313 and 1320. If the bears increase downward pressure and the XAU/USD pair falls below the support at 1277, it is likely that we will be testing 1268 and then 1263.80 (where the bottom of the Ichimoku cloud currently sits on the daily time frame).