Gold prices continued to move higher yesterday as the American dollar weakened after the minutes from the Federal Open Market Committee's latest gathering suggested the U.S. central bank may hold interest rates extremely low for longer than previously thought. Considering the fact that the Fed will not raise rates any time soon, it wouldn't be surprising to see the bulls taking advantage of the situation.

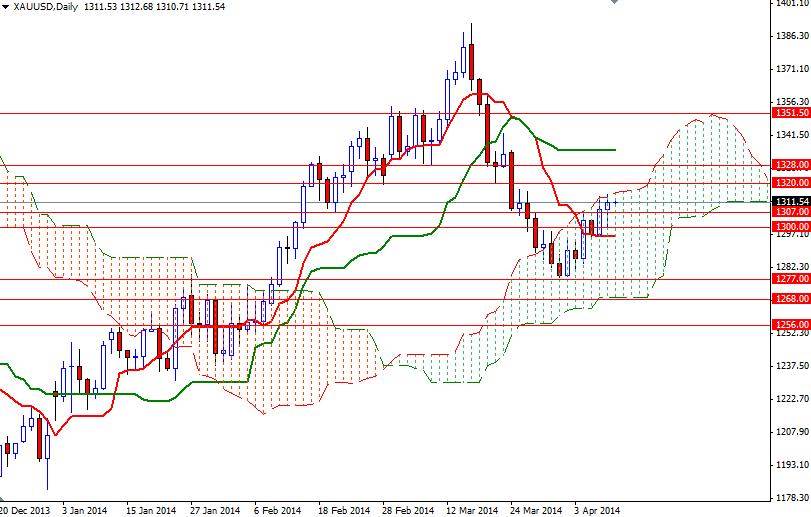

Currently the XAU/USD pair is trading above the Ichimoku cloud on the 4-hour time frame, so speaking strictly based on the charts, it seems that there is still some room for the pair to run higher as long as the market holds above the 1307 level. The bulls are trying to increase the pressure by the time I write and because of that I will be watching the 1314 resistance level closely. If they manage to shatter this first barrier, it is technically possible to witness the pair extending its gains and heading towards the 1328 level.

But before reaching that point, the bulls will have to break through the 1320 resistance level first. To the down side, there is an interim support at the 1307 level and the bears will have to pull prices below that level in order to march towards the 1300 - 1297 support area. Closing below this support on a daily basis would indicate that 1293 and 1286 will be tested soon after. In the meantime, I will also keep an eye on the USD/JPY pair and major stock markets.