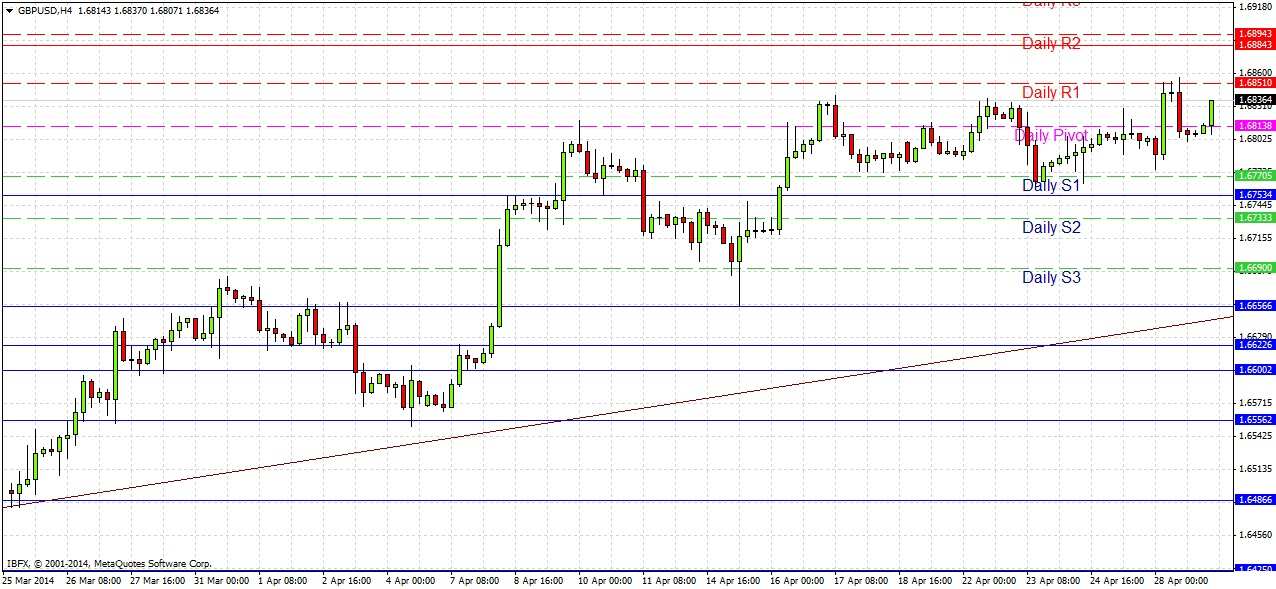

GBP/USD Signal Update

Yesterday’s signals expired without being triggered.

Today’s GBP/USD Signals

Risk 0.75%

Entries may be made between 8am and 5pm London time today only.

Short Trade 1

Short entry following confirming strongly bearish price action on the H1 chart after a first touch of 1.6884.

Place a stop loss 1 pip above the local swing high.

Adjust the stop loss to break even and take half the position as profit at 1.6815 and leave the remainder to run until 1.6760.

Long Trade 1

Go long following confirming bullish price action on the H1 chart after a first touch of 1.6753.

Place a stop loss 1 pip below the local swing low.

Take the risk off the trade when the price reaches 1.6784.

Take 50% of the position as profit at 1.6825 and half of the remainder of the position at 1.6880.

GBP/USD Analysis

Yesterday printed a fairly wide-ranging and slightly bullish doji; after the price spiked up around the London open and then spent the rest of the session falling off after it turned around fairly quickly. Overnight we have been rising and there is every reason to maintain a bullish bias on this pair. Yesterday we made another 5-year high.

Although it looks like the price will rise, the day’s direction could be set by the GBP news due this morning not long after the London session starts. If it is good news, it should have a very bullish impact. Bad news might spike the price down to a good level at which to take a long entry.

The support below us at 1.6753 was almost reached recently but should still be good.

Although everything looks very bullish it should be noted we cannot get a daily close above 1.6825 and this is a level that should be watched regarding closes going forward.

There is UK Preliminary GDP data due today at 9:30am London time. At 3pm there will be a release of US CB Consumer Confidence which could affect the USD. As the GBP is strongest global currency at the moment and we have high-impact news due on both sides of the pair, this should be relatively active today.