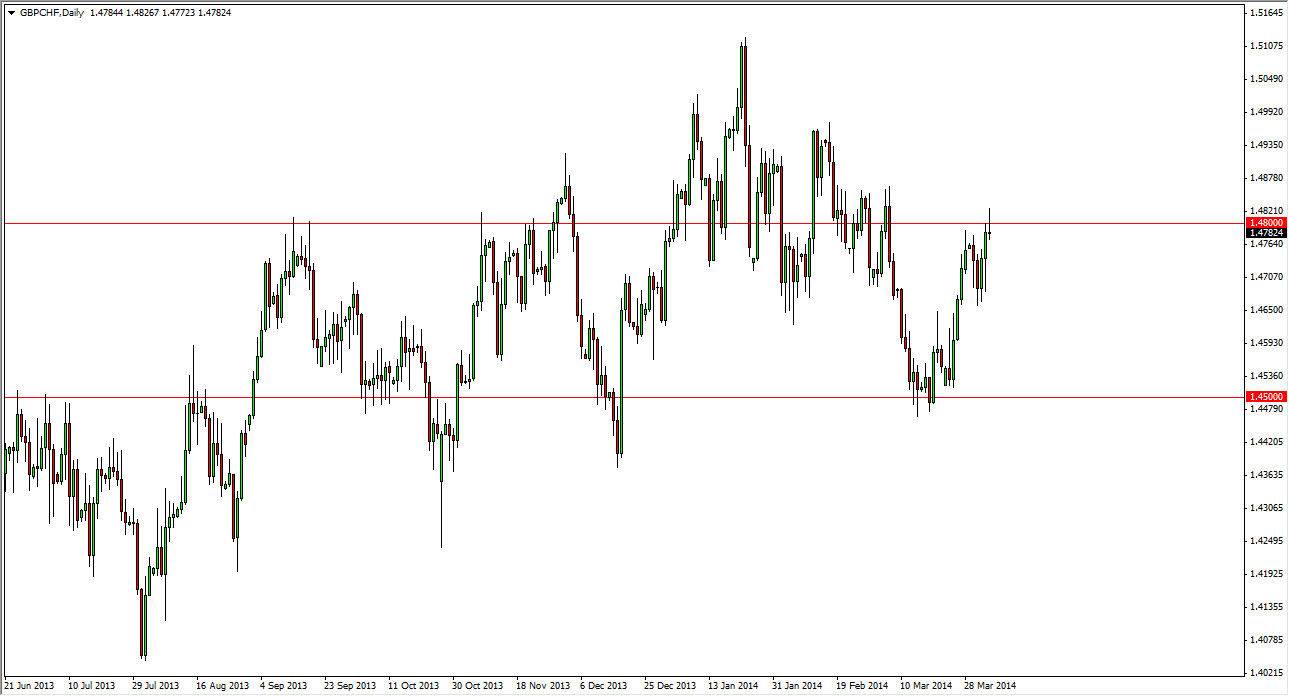

The GBP/CHF pair is one of my favorite pairs to trade when the markets finally make up their mind as to whether it’s “risk on”, or “risk off” at the moment. That’s because the British pound will be strong against the Swiss franc, a traditionally “safe currency”, and this pair really can get moving under the right circumstances. However, we have found the 1.48 level to be resistive, and have formed a shooting star on top of that.

To truly understand what’s going on in this pair, you should probably look at the USD/CHF pair as well. I have written about that particular market today, as we are starting to see a pretty nice-looking sell signal there as well. Because of that, I feel that this is a Swiss franc related move more than anything else, this probably has very little to do with the British pound itself, and as a result I feel that we will see Swiss franc strength

Short-term pullback.

I believe that this is more or less a short-term pullback. This pair has been grinding higher over the longer term, but in a very choppy manner to say the least. I don’t think that’s changed. Just that we are in an area that’s probably going to cause a pullback again. This is a short-term trading opportunity as far as I can see, and on a break of the bottom of the shooting star, I would be willing to sell this market for roughly 100 pips worth of profit. We could go lower than that, and if we do break down below the 1.4650 handle, I see absolutely nothing stopping this market from heading down to the 1.45 handle. However, ultimately I do believe that we break out to the upside and would be very interested in buying this pair on a break above the top of the shooting star as it would show the resistance being broken.

Pay attention to the world’s markets, and if the stock markets tend to do fairly well during the session, this pair should as well. Of course, that was both ways so if we see the stock markets out there selling off, the move lower in this pair would be somewhat confirmed.