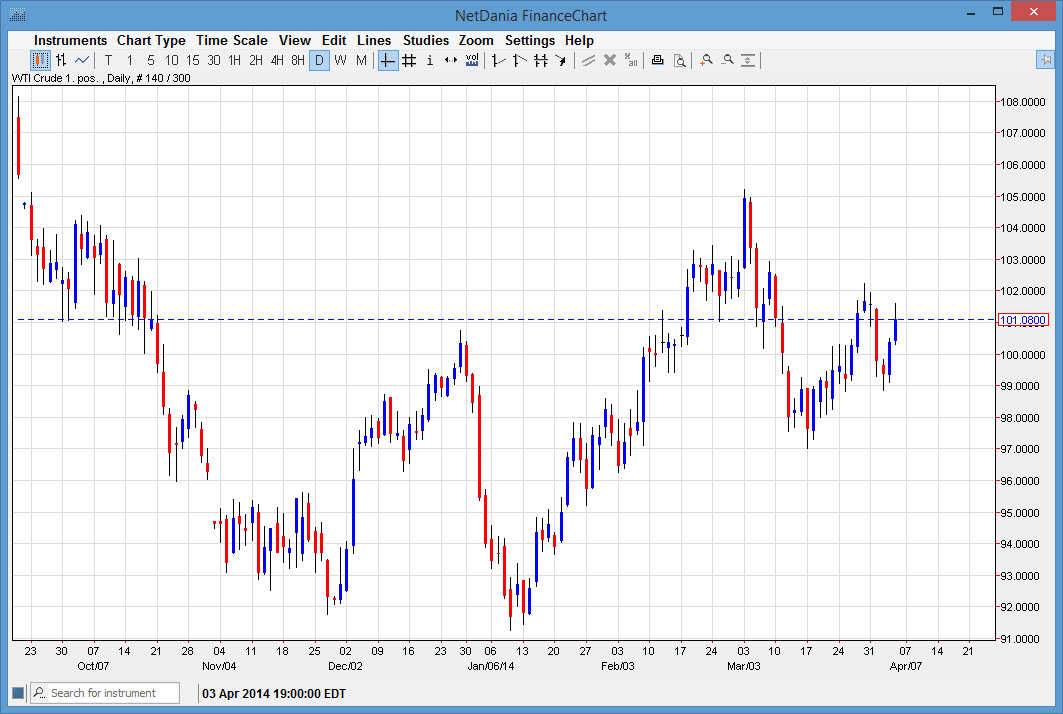

The WTI Crude Oil markets rose during the session on Friday, breaking above the $101 level. However, we are still below the recent high of the $102 level that formed a shooting star, leading me to believe that the market is still going to struggle a little bit above current levels. Regardless though, I feel that this market is eventually going to break out to the upside, but also recognize that there is a significant amount resistance between here and the $103 level. That being the case, I am waiting until we break above the $103 level in order to start buying as I believe at that point time the market would head to the $105 level without too many issues.

Because of this, I am so bullish this market and will look for pullbacks as potential buying opportunities, using the short-term charts as a guide. I believe that the $99 level should be massive support, and I also believe that the support extends all the way down to the $97 level below.

Continue the bullishness...

I believe that the market will continue the bullishness overall, but there are clusters that we will have to work through just as it would be the case with any marketplace. With that, I believe that buying can be done if you have the wherewithal to hang onto the trade, but if you would prefer to play and a little bit safer, you could wait until pullback showed some type of supportive candle that way you know that you’re getting “value.”

I believe that ultimately this market will go above the $105 level, but recognize that it will take a bit of a fight between here and there over the course of several weeks more than likely to continue the run above it. Selling certainly is in an issue though, because I see absolutely no reason to do so until we get below at least the 97 handle, and quite frankly it wouldn’t surprise me to see this market fall all the way to $95 and still find plenty of support.