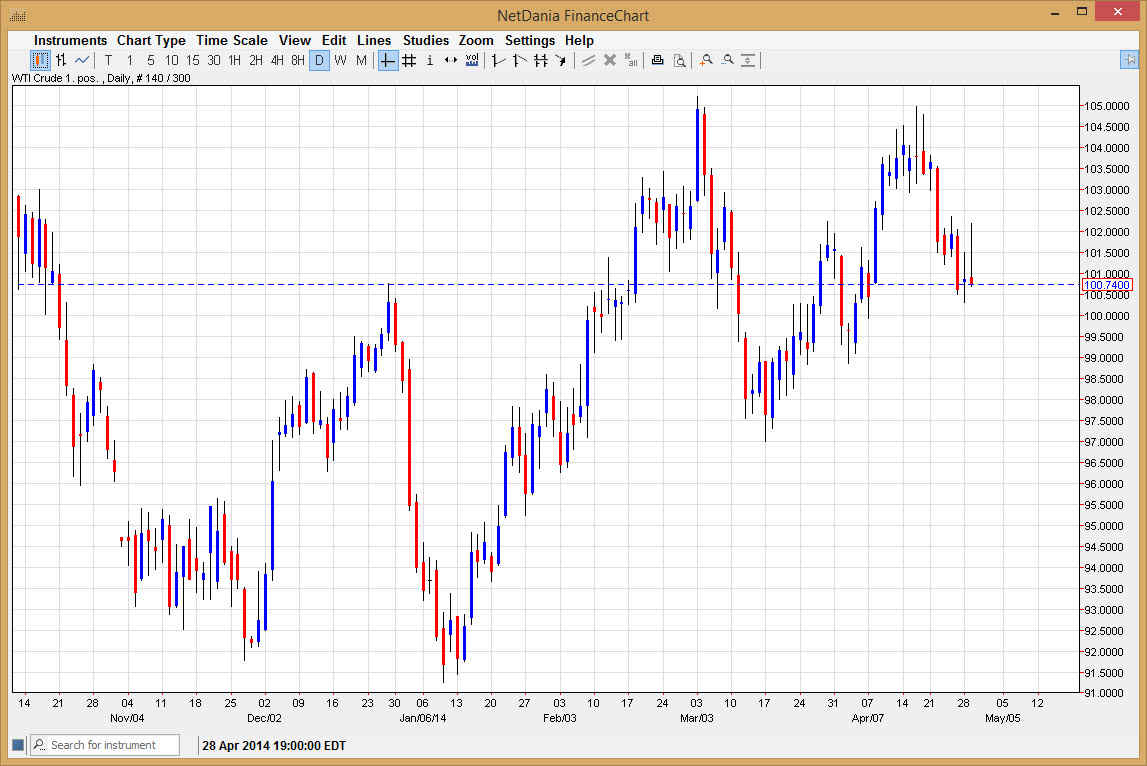

The WTI Crude Oil markets tried to rally during the bulk of the session on Tuesday, but as you can see found enough resistance near the $102 level to keep the market somewhat soft. This soft market formed a shooting star, and that of course is a very negative sign. With that, I believe that this market will probably try to pull back a little bit at this point, but there is so much in the way of support between here and the $97 level that I find it almost impossible to short this market even with all of this bearishness. I think this is a short-term move, and more than likely will offer a nice buying opportunity going forward. Of course, we need to see a supportive candle in order to start placing money into the market, but I feel that it’s only a matter of time before that does in fact happen.

Possible consolidation area.

It’s a little bit early to say, but it is possible that we are forming a consolidation area between the $105 level on the top, and the $97 level on the bottom. Because of this, I think that a lot of people will be interested in the $97 handle, and willing to put money to work. I find it difficult to imagine that this market is going to melt down anytime soon, simply because there are far too many things out there that can push oil higher, namely the issue with the Russians and the Crimean Peninsula.

Because of this, I feel that this is a “buy only market” for the most part, and even though I recognize that markets can and will do whatever they want, the truth is I’m just not comfortable shorting this market right now, even with this massive shooting star. With that, I am going to wait for that supportive candle in order to go long. Once I get it, I believe that we will first attempt to reach the hundred five dollars level, and then ultimately break above there and aim for the $110 level given enough time.