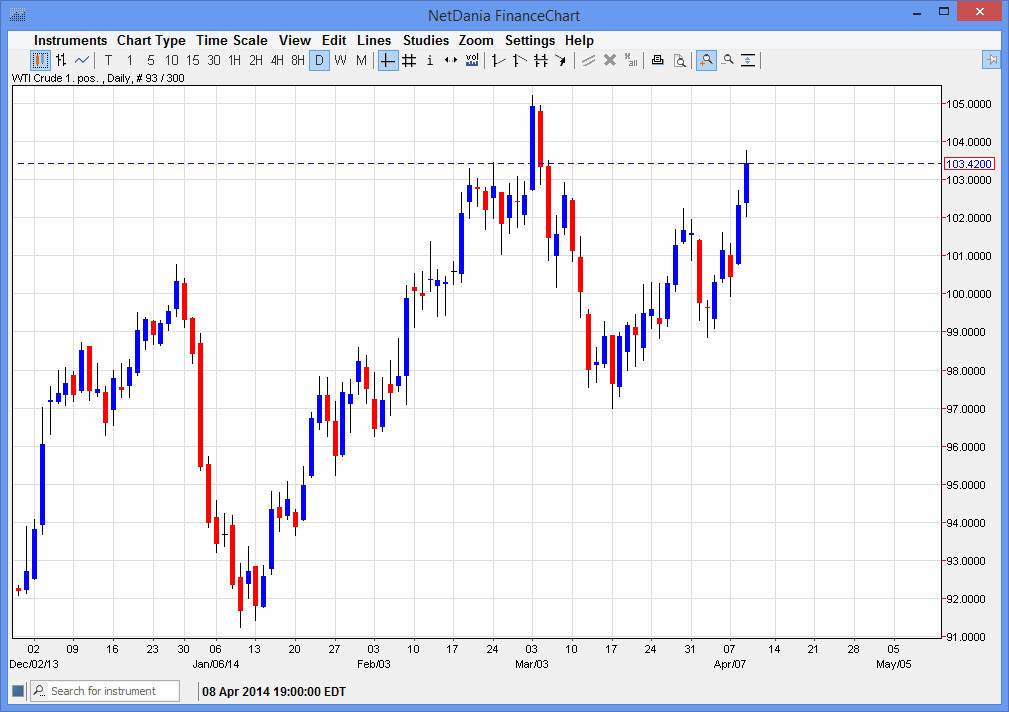

The WTI Crude Oil markets rose during the session on Wednesday, breaking above the $103 level. That being the case, it appears the market is trying to go higher, and the buyers have certainly stepped up the pressure. Because of this, it feels like the market is going to try to continue to go higher, heading to the $105 level given enough time. At that area, we should see a significant amount of resistance, but I believe that the market should continue to find buyers every time it falls.

The $101 level looks as if it should be supportive as well, so we think that any pullback all the way to that area should be a buying opportunity, especially we get the right supportive candle. In fact, we could even see support all the way down to the $97 level, but there is so much in the way of noise below, so there is no defined area that we would be looking at.

Buy on the pullbacks, selling isn’t an option.

I plan on buying on the pullbacks in this marketplace, and selling simply is not an option. With all of the noise below, it’s going to be far too dangerous to do that, and as a result it’s difficult to imagine that the market is going to break down significantly without a serious fight. I believe that ultimately the market is going to break above the $105 level above, and as a result sooner or later we should see the 110 level, but it will take some time as there is a lot of noise out there in the headlines as well, especially with the Russians and the Ukrainians in a bit of a standoff. Remember, Russia is a major exporter of crude oil, and that of course will have an effect on energy markets in general.

It is not until we get below the $97 level that I would be interested in selling. This is something that I do not see happening anytime soon, and as a result I’m essentially “buy only” at this moment.