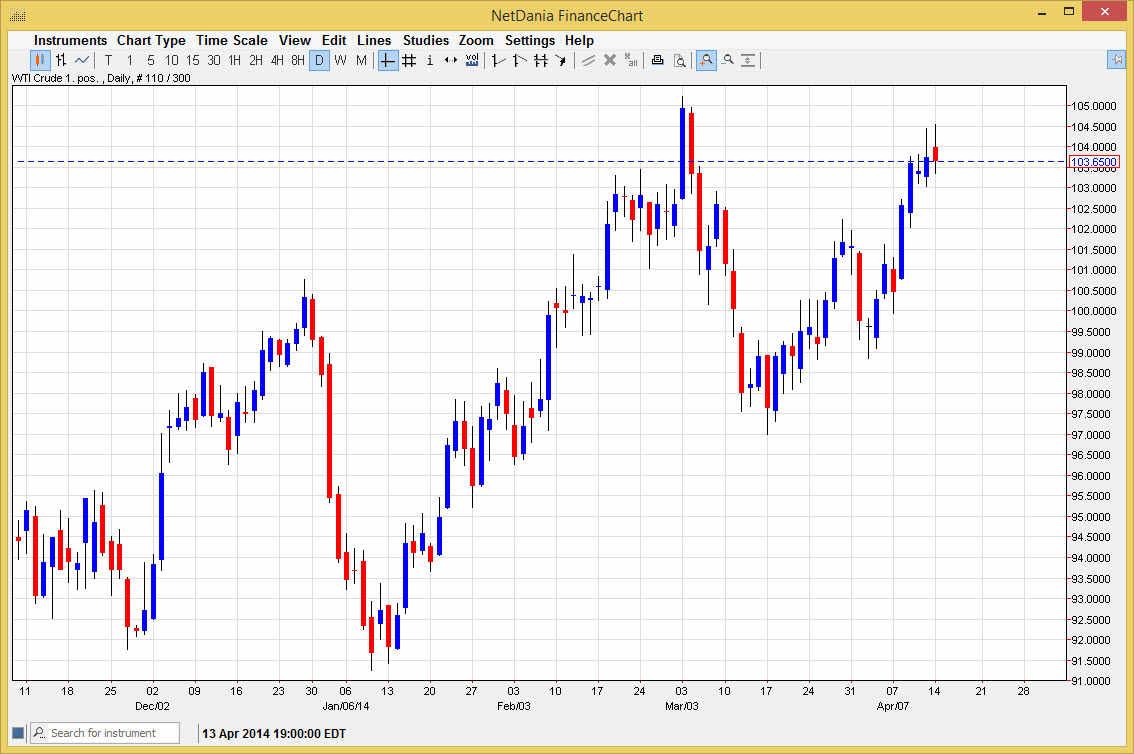

The WTI Crude Oil markets initially session on Monday, but as you can see turned back around at the 104.50 level. With that, I feel that the market will continue to struggle in this general vicinity as we have now seen to shooting stars in a row. The shooting star of course is one of the more bearish signs out there, so with that I feel that this market will probably pull back. However, there is a significant amount of support just below this area to make the market bounce from the 102.00 level. With that, I suspect that this market probably only has a limited amount of bearishness in it, and with that I would expect this to be a fairly decent buying opportunity if we do in fact fall from here.

However, that area should be supportive enough that I think I would be willing to jump into the market based upon any type of supportive candle near it. I also suspect that there is a lot of support below, so quite frankly I will be looking to take advantage of it.

Longer-term uptrend

The longer-term move seems to be have been confirmed a few weeks ago, as the 97.00 level offered support. The candles over the last two sessions formed shooting stars, so it would make sense that the market pulls back. However, a break above them would be a strong sign as well. The 105.00 level is just above though, so I would be cautious about going long until we clear that region as well. The level is a significant longer-term psychological level that the market will have to deal with. However, I think that the trend in oil has shown itself to be strong enough to break above that barrier. In the end, I think this market is probably going to head to the 110.00 level, but might have to pull back in order to collect enough bullish momentum to bust through. At this point in time, I cannot make the connection to selling this market, even though I think the next (albeit short) move is lower.