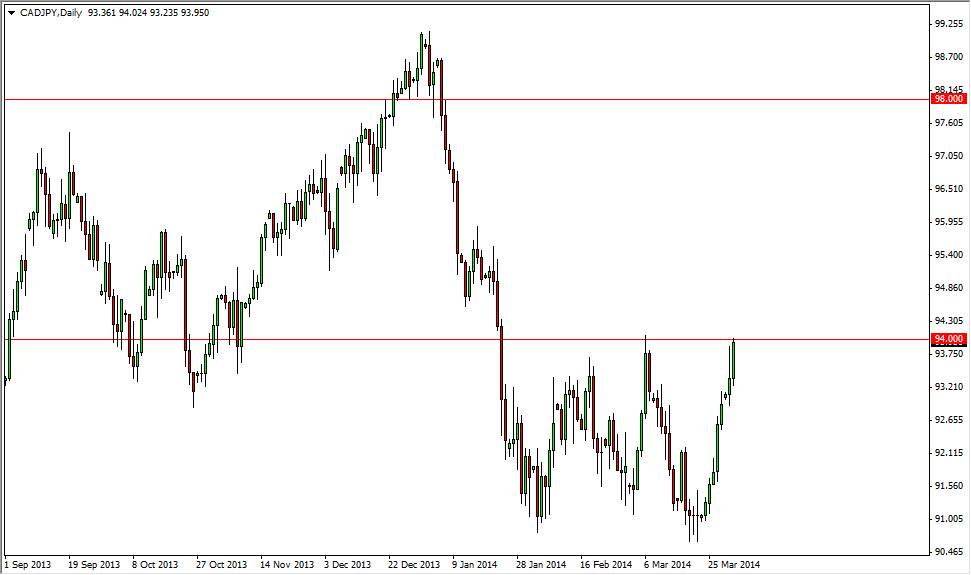

The CAD/JPY pair broke higher during the session on Tuesday, and cleared the top of the shooting star for Monday, which of course is a very bullish sign. This bullish sign of course is something that has, intention, and breaking above the area now as far as I can see would be a nice buying opportunity as we would have cleared a resistance area, and perhaps form some type of bottom in this market.

Having said that, on a daily close above the 94 handle, I believe that this market then makes a move towards the 98 handle, possibly even 99. Don’t get me wrong, I’m sure that this pair will be plenty volatile, just as most of the Forex markets, but at the end of the day I think that the longer-term move is still going to be to the upside as the Japanese yen continues to be weakened by the Bank of Japan through its quantitative easing program.

While oil markets fall apart on Tuesday, so why is the Canadian dollar still gaining?

I find it on that the oil markets fall, but the Canadian dollar continues to gain against the Japanese yen. This to me suggests that this pair is more about the Yen, and less about the Canadian dollar. It really doesn’t matter, to me it seems as if this market has already made up its mind, and that we are next heading to the 95 level. If we can get above the $94 scratch that the 94 level on a daily close, I see no reason why we won’t go to at least 95 in the short-term, which of course could cause a bit of resistance just simply because of the fact that it is a large, round, psychologically significant number.

Any pullback from there should find support at the 94 handle though, and I believe that it will be another buying opportunity on a supportive candle in that general vicinity. I think this is one of those pairs that we will be able to buy again and again, and just simply look for dips in order to get involved.