By: John Ursus

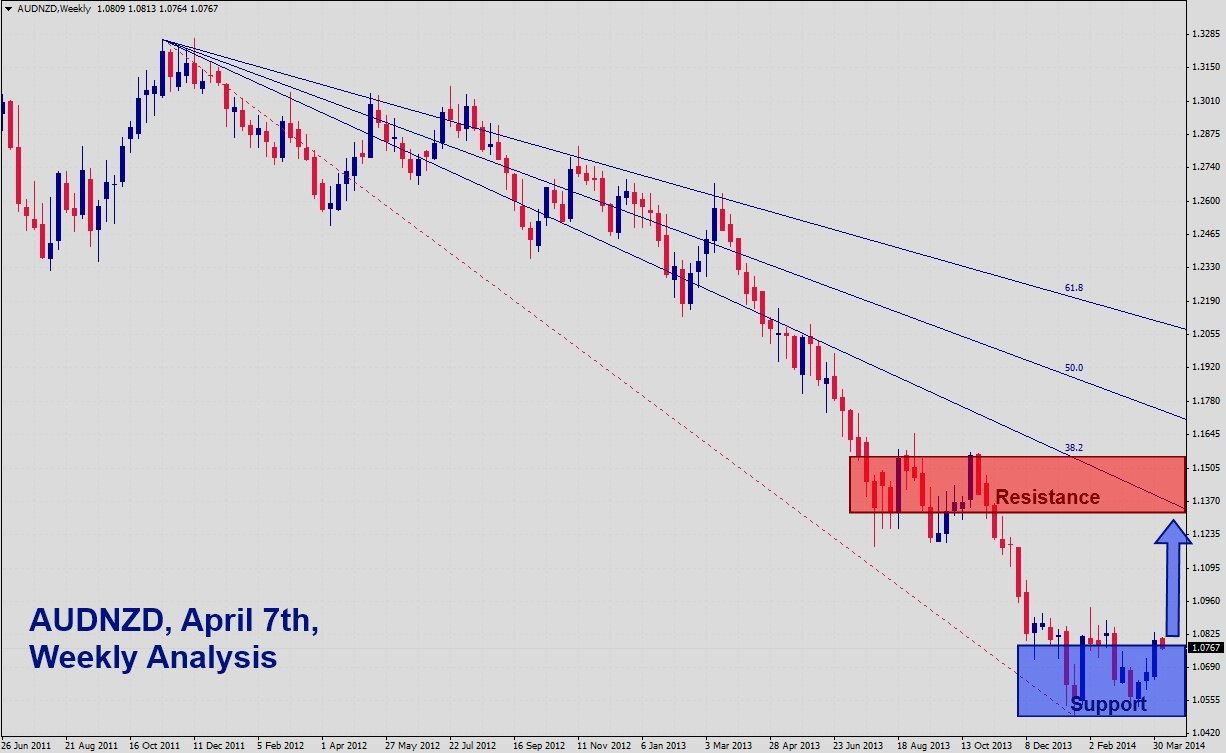

Timeframe: W1 Recommendation: Long Position

Entry Zone: 1.0500 – 1.0800

Take Profit Zone: 1.1250 – 1.1350

Stop Loss Zone: 1.0350 – 1.0400

The AUDNZD has resumed its correction as visible in this W1 chart. The past few weeks price action disconnected from its descending resistance level which signals that the sell-off became too steep too fast. The sell-off has lost some strength and the AUDNZD started to trade sideways which allowed the creation of a support level.

This currency pair is currently attempting a breakout above its current support level which could result in a sharper rally and take the AUDNZD back into its descending resistance level. The rally could last roughly 500 pips before this currency pair will reach any resistance. A failure to successfully breakout could lead to a reversal and test its most recent lows.