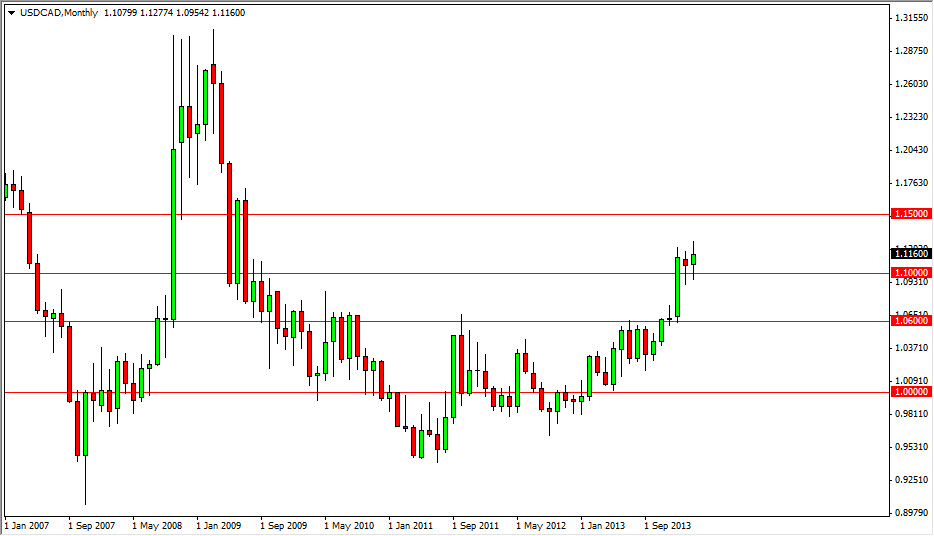

The USD/CAD pair has recently been meandering around the 1.11 level, as I write this forecast. I believe that this market still has plenty of bullish momentum, and we will eventually hit the 1.15 level. In fact, I fully anticipate that we will hit several times over the course of the next couple of months. Whether or not we can get above that level is probably a completely different question, and quite frankly I don’t think we will. It would not surprise me at all to see that level keep the market down.

If that’s the case, we then have to think about whether or not the market can break down at this point. Right now, I would have to say that it’s very unlikely. After all, the Federal Reserve and the Bank of Canada are on two divergent paths at the moment. The Federal Reserve is obviously tightening its monetary policy, and probably will continue to do so. On the other hand, recent comments out of the Bank of Canada has suggested that interest-rate cuts aren’t necessarily out of the realm of possibility. While the Canadians typically offer more interest than the Americans, the gap currencies should be closing if any of that comes to fruition.

Range trading is probably what we are going to see.

I believe that this market will continue to be very consolidative, and as a result I anticipate the range trading will probably be the best way to play this market, albeit with an upward bias. I think that the 1.10 level will continue to offer support, probably extending all the way down to the 1.09 handle. Any move that tries that area will more than likely find buyers. Even if it didn’t, I believe that the 1.06 level is about as rock solid as we are going to get is far as support is concerned.

On the upside, as I said I just don’t see the 1.15 level giving away fairly easily. In fact, I think it would take a cut buying the Bank of Canada in order for that to happen. Nonetheless, I much more comfortable been long of this pair than short. I think most traders will do quite well if they simply play this 500 PIP range with shorter-term charts. After all, there’s nothing wrong with taking 100 or 200 pips at a time out of the marketplace!