Gold prices settled lower yesterday, extending losses to second straight session, as easing fears of a wider conflict stemming from Russia and Ukraine dented the previous metal's safe-haven appeal. The American dollar was also supported by better than expected U.S. housing data. The Commerce Department's report showed that building permits climbed 7.7% to a 1.02 million pace in February.

In the meantime, the major stock markets are recovering and that is soaring the demand for disaster insurance. From a technical perspective, the weekly chart remains bearish as the pair trades below the Ichimoku cloud and because of that, I still think that there will be significant resistance levels ahead and breaking through these barriers will not be so easy. Although Monday's bearish engulfing pattern supports this theory, further confirmation is required to say that the trend is about to reverse.

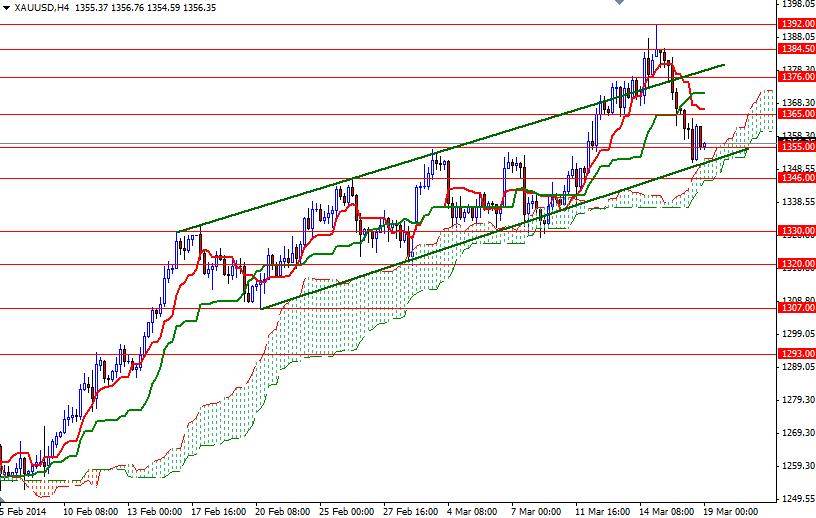

The Federal Open Market Committee concludes a two-day meeting today and until the announcement gold prices will probably continue to respect the ascending channel. That means the 1350 level where the top of the Ichimoku cloud (4-hour chart) and the bottom line of the channel reside will be supportive in the short term.

If this level remains intact and the XAU/USD pair starts to climb, the first challenge will be waiting the bulls at the 1365 level. If the bulls manage to break and hold above 1365, then we could see a test of the 1376 resistance level. If prices drop below 1346, there is a strong possibility that the market will continue to retreat and head towards the 1333/0 area. A daily close below 1330 would shift things to the bears and increase speculative selling pressure.