By: John Ursus

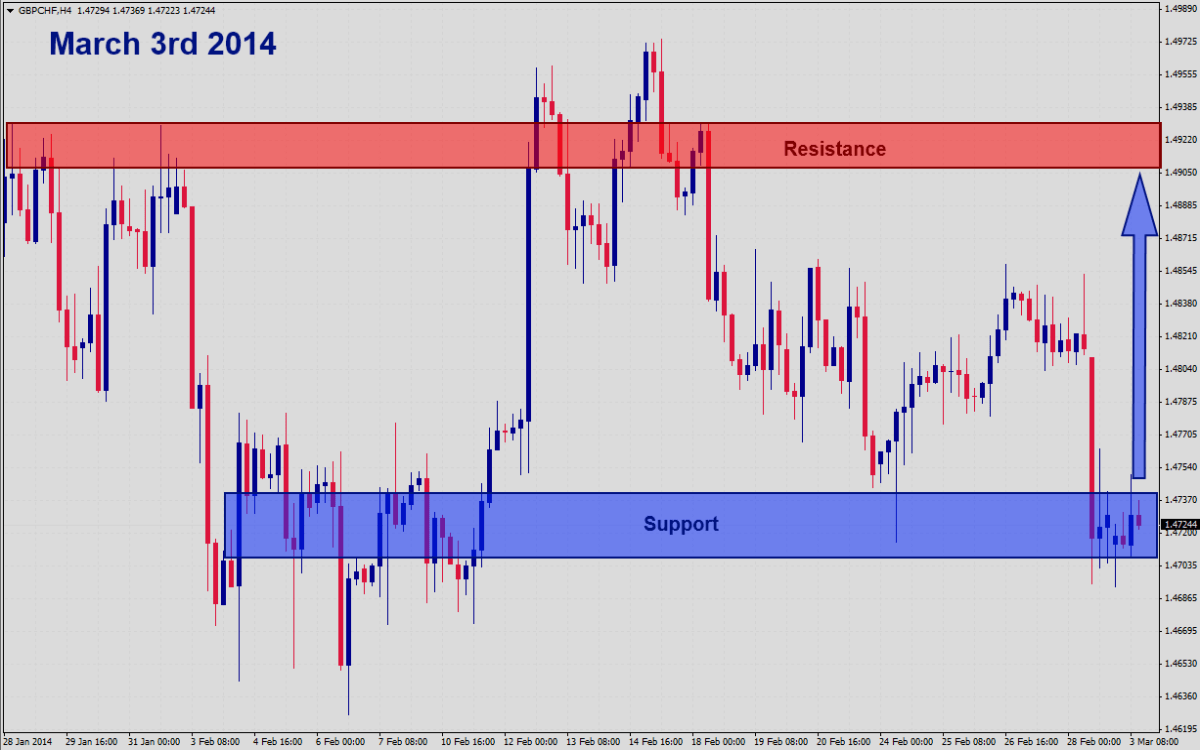

Timeframe: H4

Recommendation: Long Position

Entry Level: Short Position @ 1.4720

Take Profit Zone: 1.4870 – 1.4920

Stop Loss Level: 1.4620

The GBPCHF is nearing the end of a much needed correction as visible in this H4 chart. The correction was healthy and allows the overall uptrend in this currency pair to remain intact. The correction received its final boost by a short-term rally in the Swiss Franc fueled by geopolitical tension in Ukraine. The Swiss Franc is regarded as a safe haven current together with the Japanese Yen, but this rally should be short-lived as forex traders will soon divert their focus back to economic data.

The UK continues to overall surprise on the economic front which has powered the British Pound ahead. Providing additional bullish fuel is inflation which remains above the Bank of England’s 2.0% target while the unemployment rate continues to drop at an accelerated pace. A low unemployment rate may soon force the Bank of England to reduce its economic stimulus which will further power the British Pound ahead. Should inflation continue to remain elevated the Bank of England may also consider a rise in interest rates which would be another bullish driver for the British Pound.

Forex traders should look for long entries around current levels and may want to spread their entry over a 50 pips entry zone with multiple entries. Volatility is likely to increase given the strong support level of the GBPCHF. A breakdown of current support will result in the formation of a double bottom which is a bullish chart pattern and signal a reversal.