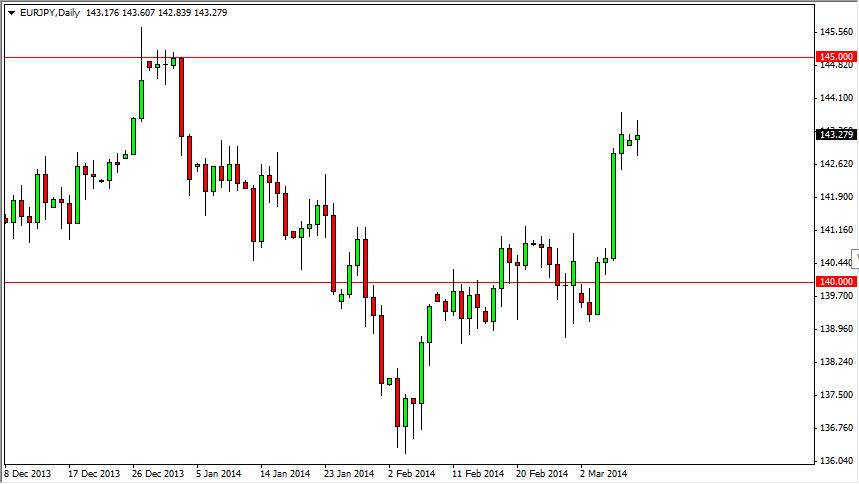

The EUR/JPY pair did very little during the session on Monday, but he did remain above the 143 level, which was the most important thing for me. This shows me that the market should continue to go higher, and as a result perhaps reach the target of 145 that I have been talking about for some time now. In fact, I don’t really see much in the way of the market reaching that area, but the fact that we are grinding sideways at the moment doesn’t surprise me either. After all, we did move higher on a fairly parabolic move, and this of course invites a rest as the market is probably somewhat exhausted from breaking through a fairly significant resistance area.

On top of that, the parabolic move was solid. The large candle on Thursday closed and almost the exact top of the range, so that tells me that the market has certainly become very bullish. There was no pullback, there was no hesitation.

145 could be just the beginning.

The 145 level could be just the beginning, and I think that this pair eventually hits the 150 level. However, 145 does look a bit resistive, as it was so tough back in December when we had it. It could take a significant amount of effort to break out above there, but one cannot help but notice that this happened right around Christmas time, which of course would been very low liquidity. So we have to ask ourselves whether or not it was a real move? We should find out fairly soon, but I am inclined to believe that the 145 level will cause a reaction based upon psychological significance if nothing else.

Remember that this is a “risk on” currency pair, and it tends to rise when the markets are happy. There are a lot of potential “risk on” signals at the moment, so having said that I am bullish of this pair, but do recognize that we have to chew through significant resistance at 145 to continue going higher.