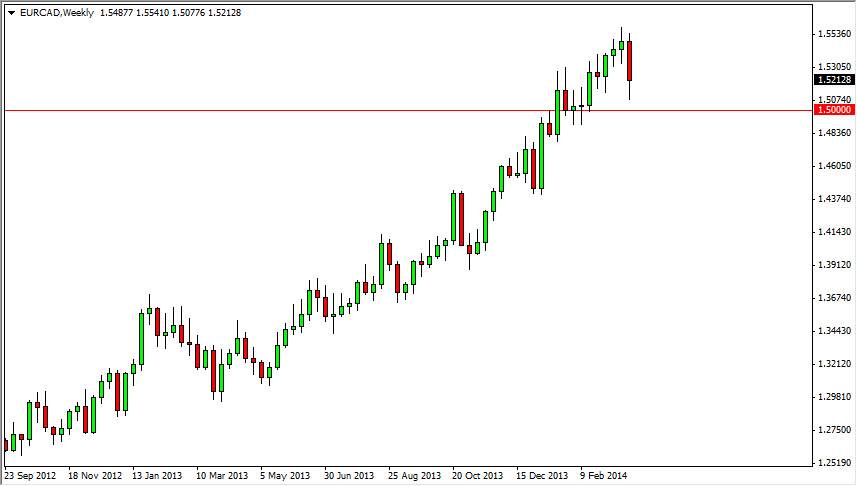

On the attached chart, you can see that the EUR/CAD pair had a rough week to end the month of March. However, you can also see that I have the 1.50 level drawn just below there on the chart with a horizontal red line, which I believe will serve as a bit of major support for this marketplace. After all, the Canadian dollar has been beat up pretty severely lately, and the Euro continues to defy gravity. The thing that you have to keep in mind is that Forex is about trading relative strength, not necessarily whether or not you believe either currency is worth the paper it’s printed on so to speak.

There’s an obvious uptrend in this market, so the first thing that you should be thinking is that you want to buy it, not sell it. The fact that we did bounce a little bit towards the end of the week and quite frankly on Friday formed a little bit of a hammer tells me that there is still plenty of buying pressure underneath.

Simply following the trend.

As far as is market is concerned, I will simply be following the trend, as the Canadian dollar has been so weak over the last several months. I also like the fact that the 1.50 level is just below, because it is about as significant of a number as you can come up with, and as a result this is probably the best spot I can imagine based on the number itself to start getting involved again.

Going forward, I think that the market will more than likely try to target the 1.55 level again during the month of April, but I would not be surprised at all to see the market break above that level and continue going higher. Another thing you will want to watch is the EUR/USD pair, as it will be the main driver of what goes on, unless of course the Canadian dollar falls apart completely. That being the case, if the EUR/USD gets above the 1.40 handle, this market should absolutely check out to the upside. Below the 1.50 level however, I would be concerned about this uptrend.