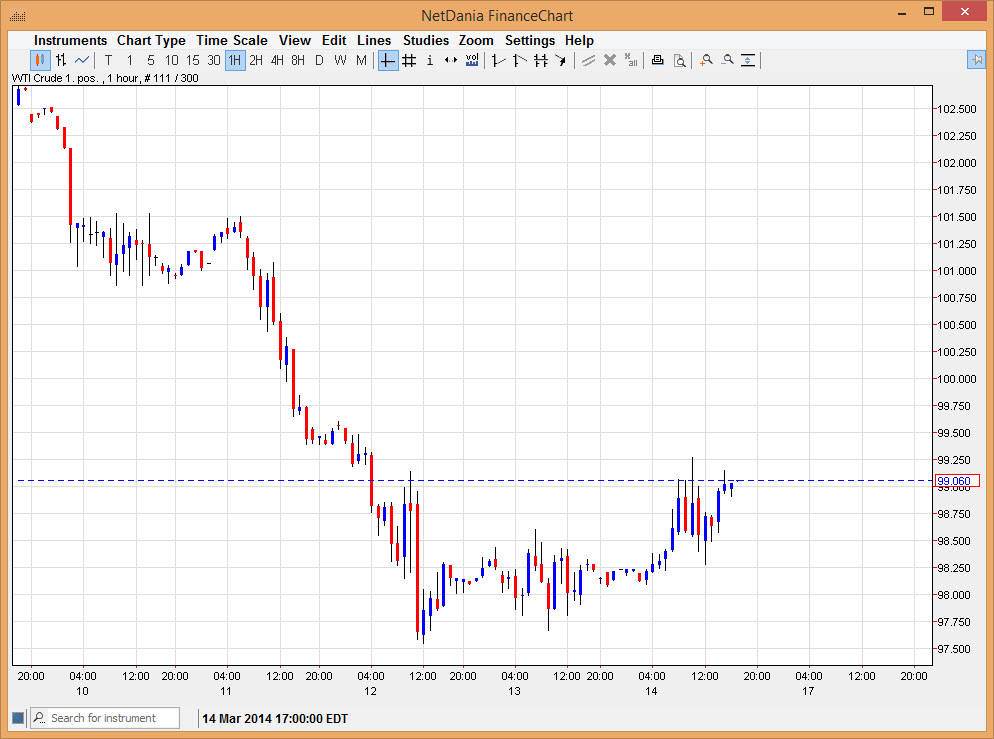

The WTI Crude Oil markets initially fell during the session on Friday, but as you can see found enough support to turn things back around and form a hammer. This hammer is directly after a shooting star, so this tells me that the market is probably more or less confused at the moment, or at least is hesitating. It’s not a big surprise really, when you look at the fact that there is a significant amount of resistance just above. We’ve had a very nice move higher, and the fact that the market would see here doesn’t surprise me at all. However, I would bring to your attention that we are at the very top of the recent consolidation pattern, so that tells me that the market is trying to build up enough momentum to break out to the upside, something that I think will happen given enough time anyway.

While I typically show the daily chart in this contract, the reason I’m showing the hourly chart is that just above the $99.50 level you can see that the market fell rather precipitously six or seven days ago. It’s because of this that I believe that the market will shoot through the $100 level rather quickly and up to the $101.25 level without too much in the way of delay. I think we’re pressing up against significant resistance, but it short-term resistance at best. With that, I’m very bullish of this market.

Another thing, this looks like a basing pattern.

Another thing that I’ve noticed right away is that this does in fact look like a little bit of a rounded bottom, or some other type of basing pattern. I wouldn’t get too hung up on the actual shape of the pattern, just the fact that we have formed a little bit of a “U”, and that generally means that the buyers are stepping in to support the market. Given enough time, I believe that this market goes much higher, at least to the $105 level. However, recognize that there will be choppiness between here and there.