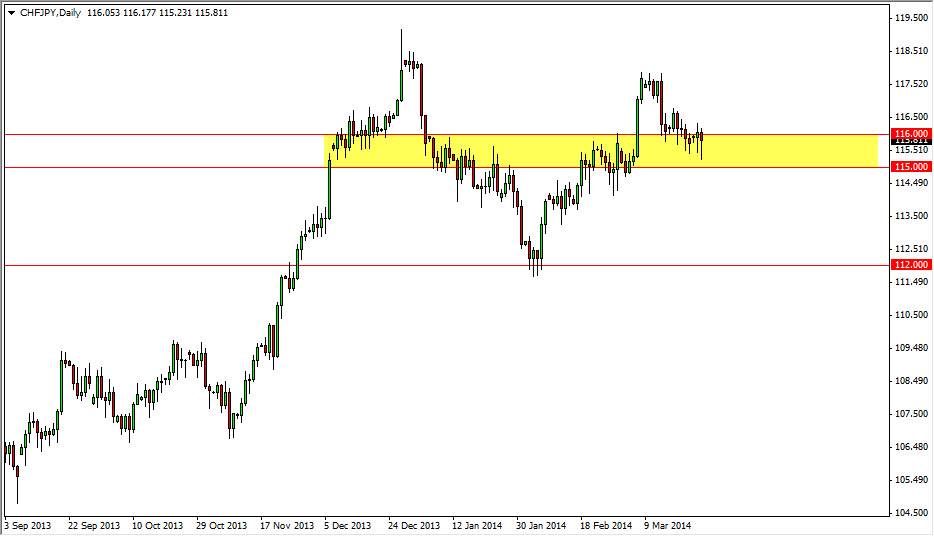

The CHF/JPY pair initially fell during the session on Tuesday, but found the area just above the 115 level be far too supportive to continue falling. The resulting bounce formed a nice hammer, which of course is a nice bullish signal. On top of that, we are focused on the 116 level, which has been the beginning of support all the way down to the 115 level, and as a result I believe that there is essentially a 100 pip thick support zone that should keep this market going higher over the longer term.

Between that and the perfect shape of the hammer I have certainly started noticing this pair again. Because of this, I feel that eventually this market should continue to go higher, probably targeting the 118 level which was the recent high that we saw just a couple of weeks ago.

Remember, this is a relative strength play.

Remember, this is a relative strength play between two safety currencies, so as a result I feel that this simply tells us that the Japanese yen will continue to get beat up upon by several different currencies, not just the Swiss franc. That being said, even if you don’t take this particular set up, you can look around the markets for other setups against the Japanese yen, as the logical thinking behind this move could have us thinking that if the Swiss franc can beat up on the Japanese yen, other currencies such as the New Zealand dollar or the British pound certainly should have their way with it as well. In other words, this could be a bit of a tertiary indicator for the JPY pairs in general.

Nonetheless, I believe that this market will target the 118 level, and then probably the 120 level as it is the next major round number. Remember though, this pair does tend to be rather stiff and as a result the moves tend to take a bit of time. If you are patient though, this is one of those pairs they can pay off quite handsomely if you just allow it.