USD/CAD

The USD/CAD pair had a negative week over the last five sessions, but found a bit of support on Friday in order to form a hammer on the daily chart. With this, I believe this market is ready to bounce and continue going higher. The market is certainly in an uptrend, and I don’t see any reason for this to change. However, I am aware that a pullback could continue. If that happens – I am looking for supportive candles all the way down to the 1.05 level in order to buy. A daily close above the 1.10 level is enough for me in this pair.

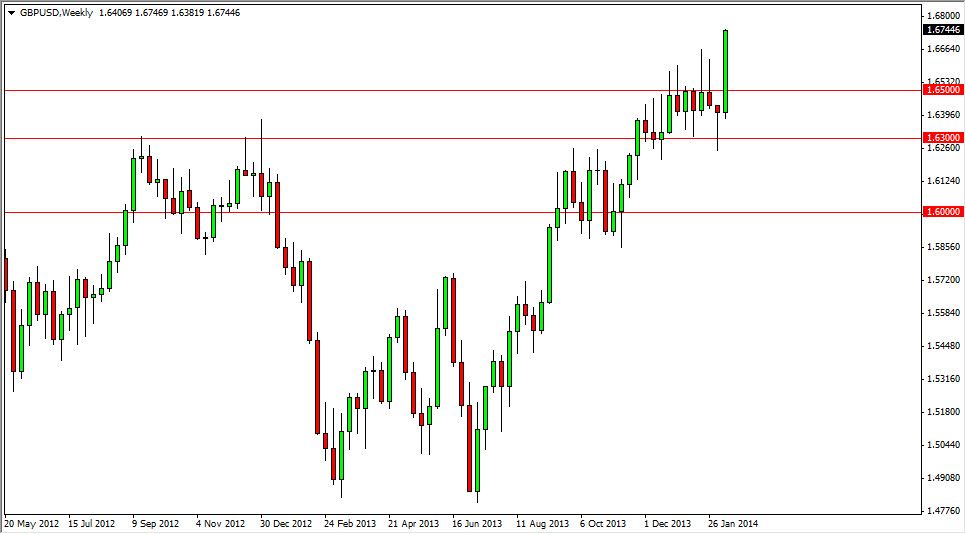

GBP/USD

The cable pair broke out to the upside during the week, something that I have been waiting for. The market had been going sideways for some time now, but as you can see – 1.63 level was very supportive, and this pair never really looked overly threatened by the sellers. With this breakout, I believe we are going to the 1.70 level, and area that I have had as a target for some time now. I look for the 1.65 level to be the “floor” going forward in this pair.

USD/JPY

The USD/JPY pair fell over the course of the week, but remained within the range of the hammer from the previous week. The area below is protected by the 100 handle, so I don’t think that the market has too far that it can fall at the moment. With that, I remain bullish overall, but recognize that we are stalling a bit here. Nonetheless, I am buying on a break above the candle for the week – which essentially buying a break of the top of the hammer from the previous week.

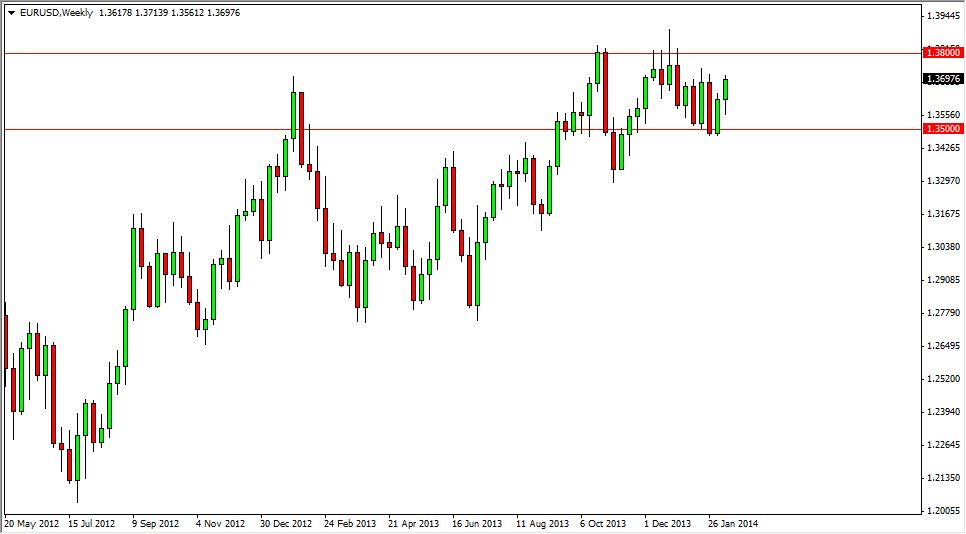

EUR/USD

The EUR/USD pair continued to chop back and forth, and it appears that we aren’t looking to change that at the moment. The pair is essentially trading back and forth between the 1.35 level on the bottom and the 1.38 level on the top. I don’t see any real reason for this pair to break out, but obviously I would be interested in a move outside of this range. Until then, this isn’t a pair that is conducive to longer-term trading, and therefore most of the action will be by day traders this week. If I had to have a bias, it would be to the upside at this point as I see a lot of choppy noise below.