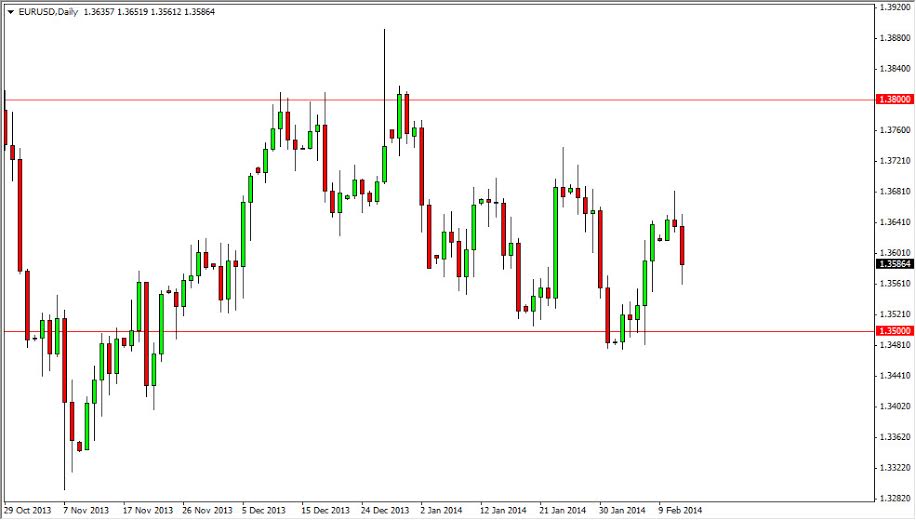

The EUR/USD pair fell during the session on Wednesday, breaking the bottom of the shooting star that we had seen form for the Tuesday session. This was a classic “sell the breakdown” type of move, but we did see a bit of support at the 1.3550 level, and as a result it appears that the market is going to struggle to reach the next natural support area, the 1.35 handle. However, I do believe that we will eventually head there, but it’s probably going to be a very bumpy ride. Because of this, it’s probably easier to sell calls above the recent shooting star than anything else, as the spot market will probably cause all kinds of headaches for anyone who is trying to trade charts higher than about the one hour timeframe.

With that being said, the longer-term outlook is a little bit cloudier. After all, Janet Yellen suggested just the other day that the Federal Reserve was on track to continue tapering off of quantitative easing, and that should strengthen the US dollar overall. This will be especially true against the Euro, an area of the world that is more than likely going to have to do something about potential deflation concerns.

Continued choppiness, difficult conditions.

I fully anticipate this market they continue to chop around and cause problems for most people involved. Quite frankly, I haven’t been that interested in trading this pair for some time now. The biggest problem with this pair is that it brings in a lot of new traders because of the spread being so small. However, if you are trading with the proper leverage, the difference between a 2 pip and 7 pip pair shouldn’t do like the one game matter much. Because of this, a lot of traders should be looking at other currency pairs.

However, the other selling point is that the EUR/USD pair is the “most liquid financial instrument” in the world. Okay, that’s fine but how many of you out there are really worried about moving the market against you with your massive account sizes and trade? Exactly. Because of this, I have no real lasting impression on this market except for if you give it enough time, any particular trade here and will eventually go your way.