By: John Ursus

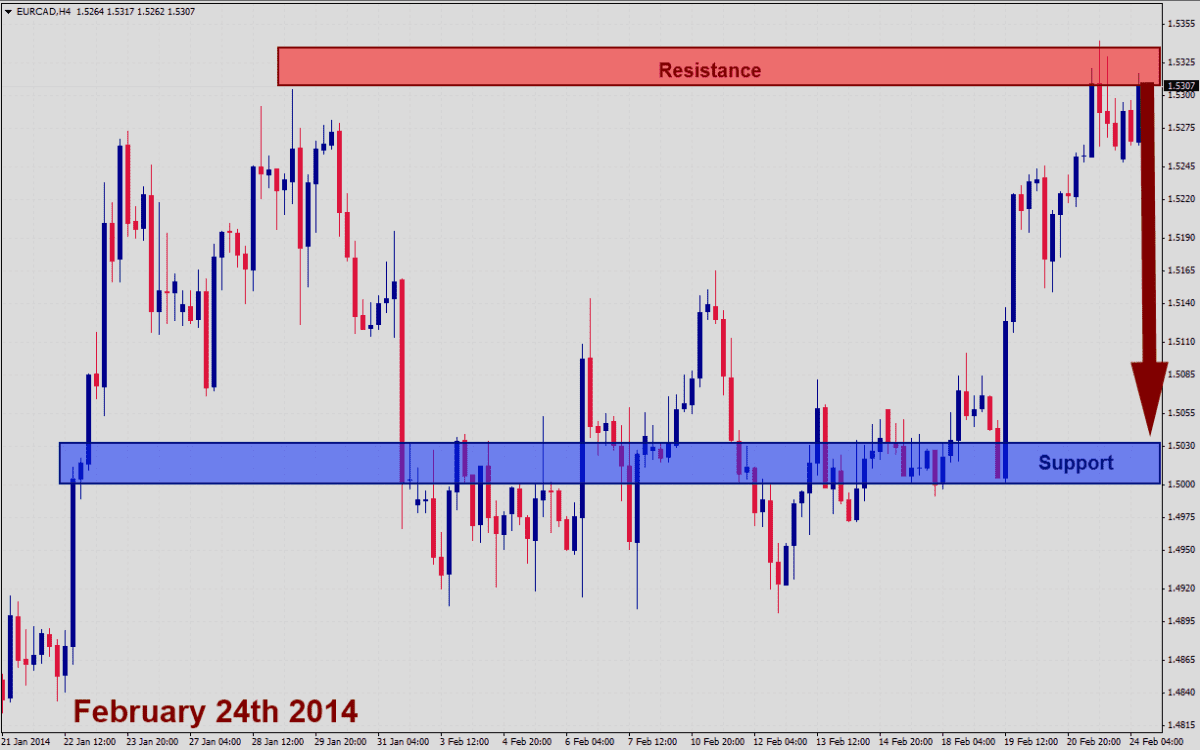

Timeframe: H4

Recommendation: Short Position

Entry Level: Short Position @ 1.5300

Take Profit Zone: 1.5000 – 1.5050

Stop Loss Level: 1.5450

The EURCAD has extended its recent rally as visible in this H4 chart. Price action initially broke out above what used to be a resistance area for this currency pair, but due to the strong move upwards has been turned into a support area. The bullish move was powered by much weaker economic data out Canada while economic data out of the Eurozone was across the board slightly better than expected.

Canadian Retail Sales data which was released last week on Friday came in much weaker than expected which reversed a minor sell-off in this currency pair. Canada has struggled more than many have expected over the past twelve months. Hopes that the European Central Bank may move to stimulate the struggling Eurozone economy have added to Euro strength.

The EURCAD is now vulnerable to a reversal rally which may be triggered by profit taking which would be a healthy development and could keep the uptrend alive. Economic data may act as a trigger for a sell-off while the technical picture should be carefully followed over the next few trading sessions in order to gauge if the most recent resistance area will be strong enough to stop another breakout in price action. Should the EURCAD struggle around current level a sell-off is very likely as this week’s Canadian GDP data could act as the trigger for a sell-off which could take the EURCAD back down to its support area.