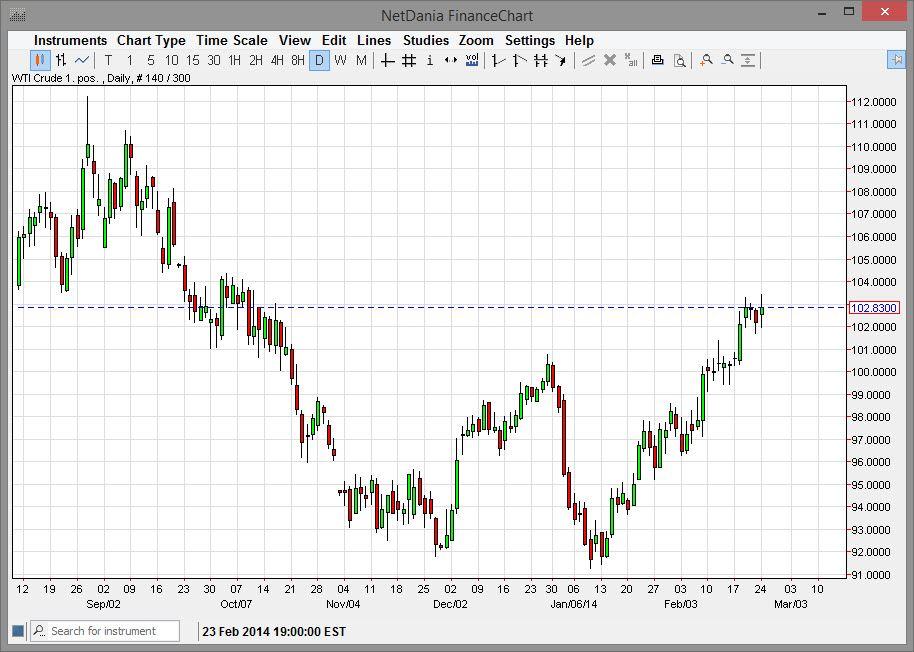

The WTI Crude market went back and forth during the session on Monday, essentially settling nothing. The one thing that the chart does show me is that the $102 level is currently acting as a little bit of a support level. However, I feel that the real support in this market is probably going to be found at $100. So having said that, I feel that any type of pullback from here down towards that level will more than likely prove itself to be a nice buying opportunity. Even though the $102 level does look supportive, it is because of the previous statement that I will not be selling on a break below that level.

The energy markets in general have done quite well lately, although natural gas did get beat up rather significantly during the session. However, keep in mind the natural gas also has a premium placed on home heating, something that the petroleum markets are rarely used for. Because of this, we could have a bit of a divergence between certain energy markets soon.

Demand rises?

The question of course then is whether or not demand is rising. After all, a strong demand for petroleum will do nothing but push this market much higher. That being said, I feel that eventually we will break out to the upside as it appears that some of the larger economies are at least pushing forward, albeit slightly. Naturally, we would have to pay attention to the British, European, and most certainly American economy is as to the signs of strength, but the chart certainly shows right now that the buyers are in control.

That being said, I believe that the $105 level will be targeted, and therefore I am willing to hold onto a bullish position until that level gets hit. Regardless, you can play this in the futures market were better yet the CFD market if it is available in your home country. This way you can tailor the position size for your account. On the other hand, I would be more than willing to buy puts below the $100 level, as I believe it’s an opportunity to make a few dollars.