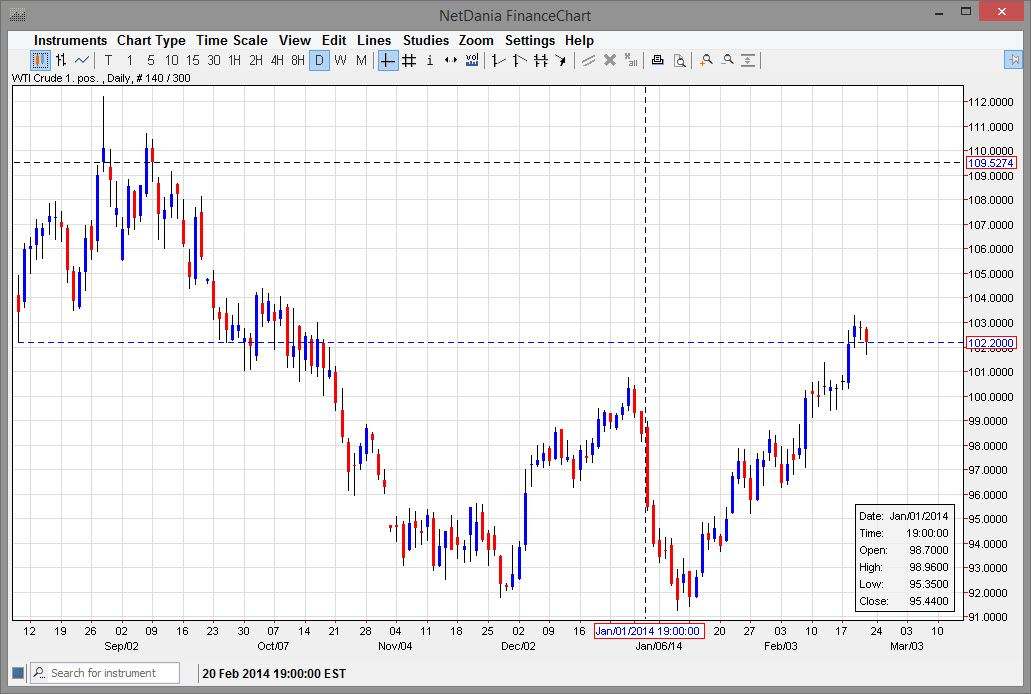

The WTI Crude Oil markets fell during the bulk of the session on Friday, but as you can see found enough support at the $102 level to turn back around and form a hammer by the end of the day. Because of this hammer, I believe that this market is still struggling, but will ultimately go higher. I think we are essentially in a consolidation area that was formed back in September, and that the top of that consolidation area will be aimed for. The top of that consolidation area of course is the $104 level, and that is my short-term target.

If we can get above the $104 level, I believe that this market will eventually sorted itself out and head towards the $110 level. There will probably be a bit of resistance and choppiness all the way up there, but quite frankly I don’t see anything significant enough on the charts to make be believe that we won’t make it.

I’m ignoring the “hanging man.”

Although the Thursday candle formed a hammer that was broken to the downside, I’m essentially ignoring the fact that it technically is a “hanging man.” Yes, I recognize the fact that it is a significantly bearish sign, but the fact that the candle for the Friday session essentially printed the identical signal, tells me that this market has an underlying bid in it.

Recognizing the fact that there is buying going on every time the market falls, I believe this market will continue to strengthen. It may not be today, but it certainly will be in the relatively near future. It would not surprise me in the meantime however, to see this market consolidating go sideways as this area caused it to do the exact same thing back in September.

Selling is not a thought at this moment in time, and I believe that there is a significant amount of support and a potential “floor” at the $100 level. It is not until we clear that area significantly that I would even consider selling at this point in time.