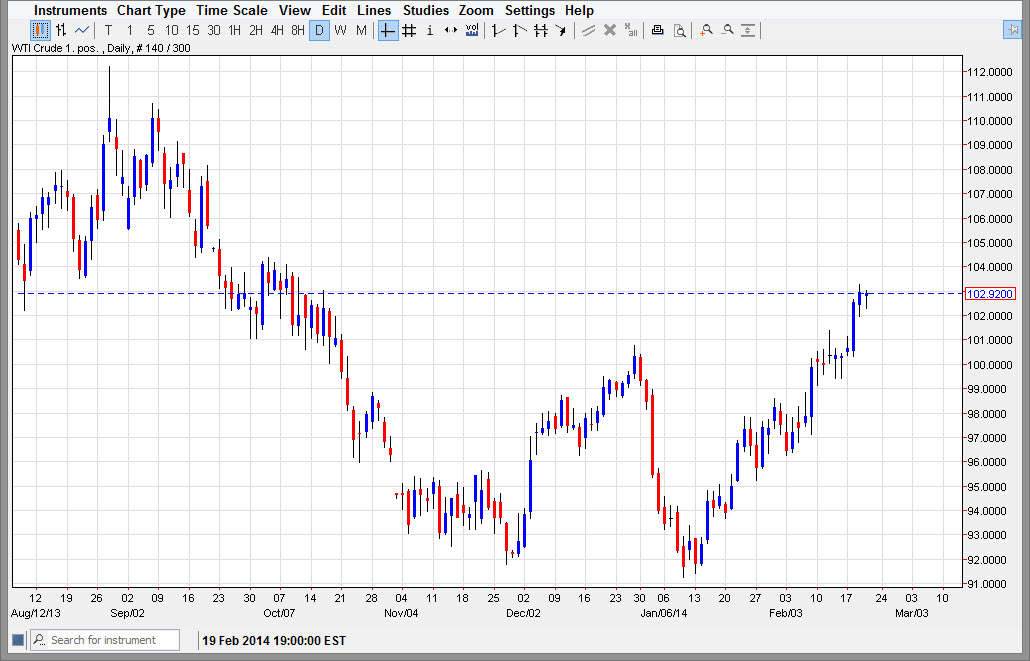

The WTI Crude Oil markets initially fell during the session on Thursday, but found enough support above the $102 level in order to bounce and form a hammer. This hammer of course suggests that the market is ready to continue going higher, something that isn’t much of a surprise considering how it has behaved over the last two months. Having said that, we need to look at the fact that the $104 level is the top of the consolidation area that we have recently entered, so I believe that the market will of course struggle at that very price. However, I believe that we will eventually smash through it as this market simply seems like it cannot fall for any significant length of time recently.

The $100 level below is as low as I think this market can go right now, so if we found some type of supportive action in that general vicinity, I would be more than willing to throw money at the market. Looking at this, I believe that the market continues to go higher on pullbacks, and they should be opportunities for people who have missed out to reenter this market. I also believe that short-term traders will continue to pushes market higher as they will jump in and out of the market, but certainly to the upside.

$110 will eventually be tested in my opinion.

I do believe that eventually we will test the $110 level, but it certainly won’t be any type of straight shot to that area. I believe that the choppiness will continue, but quite frankly if this market is traded correctly, that can actually work out to your favor. After all, if you are trading the futures market, you know that the tick value is quite high, not to mention the margin issues. On the other hand, that high-tech value can increase your profitability if you are capable to trade short-term as most residential traders don’t have the kind of money that’s actually necessary to trade the futures market directly. If not, I would suggest perhaps that you take advantage of the CFD markets.