USD/JPY Signal Update

Yesterday’s signal was not triggered and expired.

Today’s USD/JPY Signal

Risk 0.50%.

Entry should be made before 8am tomorrow London time.

Long Trade 1

Enter long with a limit order at a touch of 103.85, placing the stop loss at 103.43.

Move the stop to break even when the trade is 40 pips in profit. Take 50% of the profit at 104.97 and leave the remainder of the position to ride.

USD/JPY Analysis

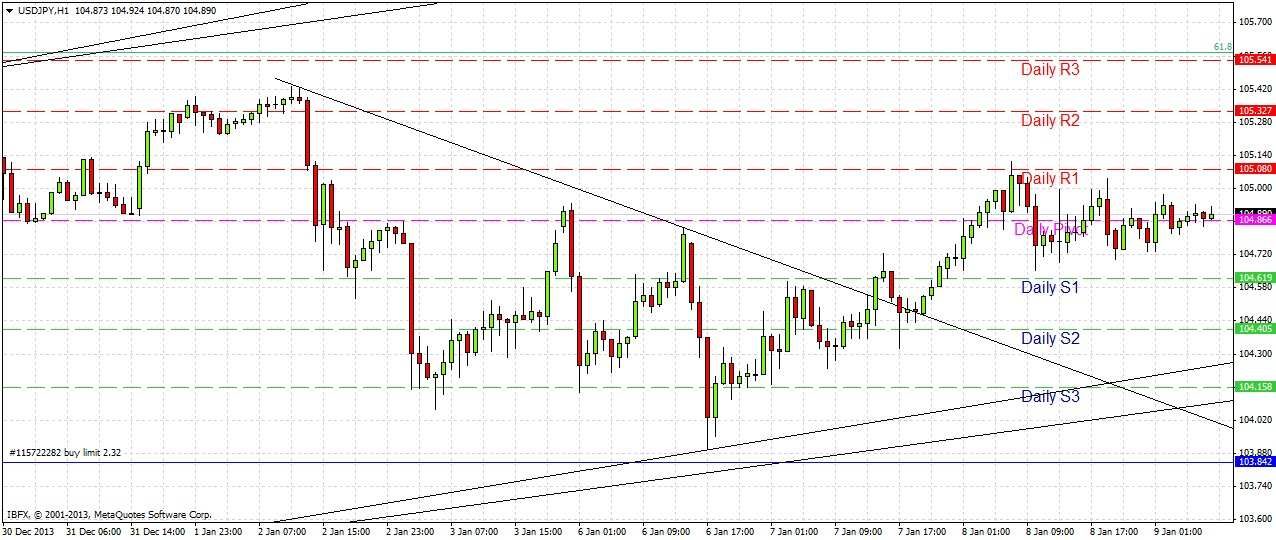

The pair was very quiet yesterday, consolidating in a small triangle with a centre of gravity just under 105.00. The price action is giving us a fairly neutral sign, although this kind of consolidation within an upwards trend can be said to be bullish:

There is very important news later today for the USD also at 1:30pm (Unemployment Claims). The pair may also be affected if anything unexpected happens with the EUR or GBP during their important news releases later today.

Not much else can be said about this pair. The bullish trend lines and the bullish channel are all still intact. The support level of 103.85 is beyond the bullish trend lines, but will soon be confluent with a retest of the broken bearish trend line.

It is unlikely that our long entry will be triggered today. No signal is given for tomorrow (Friday) but if you are trading the Non-Farm Payroll during Friday’s New York session, you might want to look cautiously for a long if the price falls sharply to 103.85.