USD/JPY Signal Update

Yesterday’s signals were not triggered and expired.

Today’s USD/JPY Signal

Long Trade 1

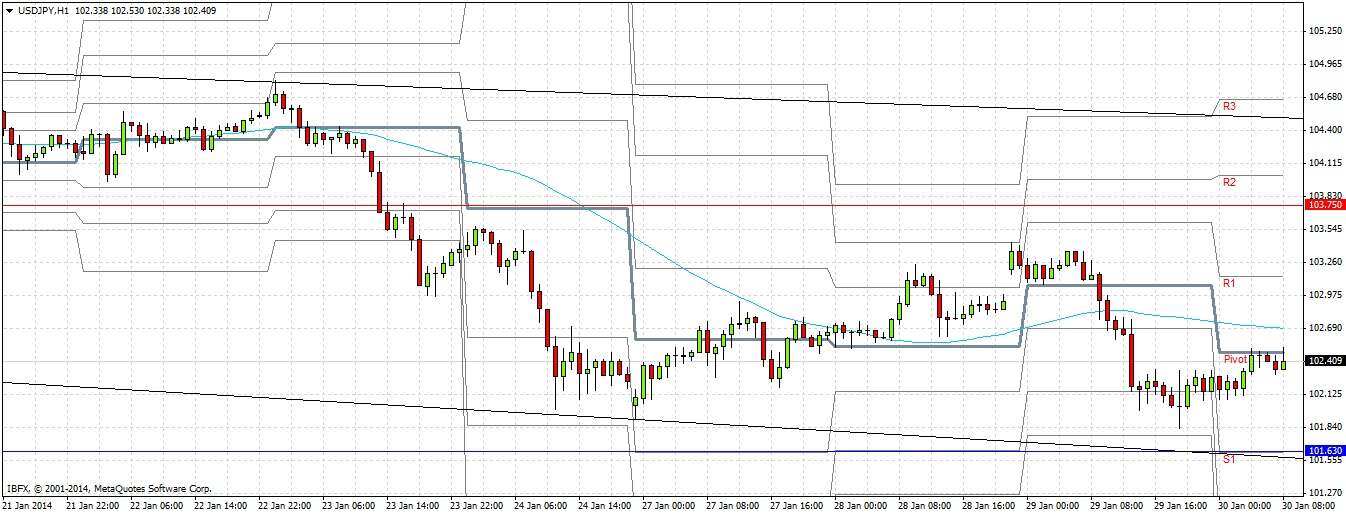

Enter long if a pin or engulfing bar is formed on the hourly chart when the price first reaches 101.63, on the break of the bar by 1 pip on the next bar. If a bar closes below 101.60, the trade is invalidated.

Stop loss at the local swing low.

Move the stop loss to break even when the trade is 25 pips in profit. Take 50% of the position as profit at 102.70 and leave the remainder of the position to run to 103.75.

Risk 0.50% and the trade may be taken until 8am London time tomorrow.

Short Trade 1

Enter short if a pin or engulfing bar is formed on the hourly chart when the price first reaches 103.75, on the break of the bar by 1 pip on the next bar. If a bar closes above 103.75, the trade is invalidated.

Stop loss at the local swing high.

Move the stop loss to break even when the trade is 25 pips in profit. Take 50% of the position as profit at 103.05 and leave the remainder of the position to run.

Risk 0.50% and the trade may be taken until 8am London time tomorrow.

USD/JPY Analysis

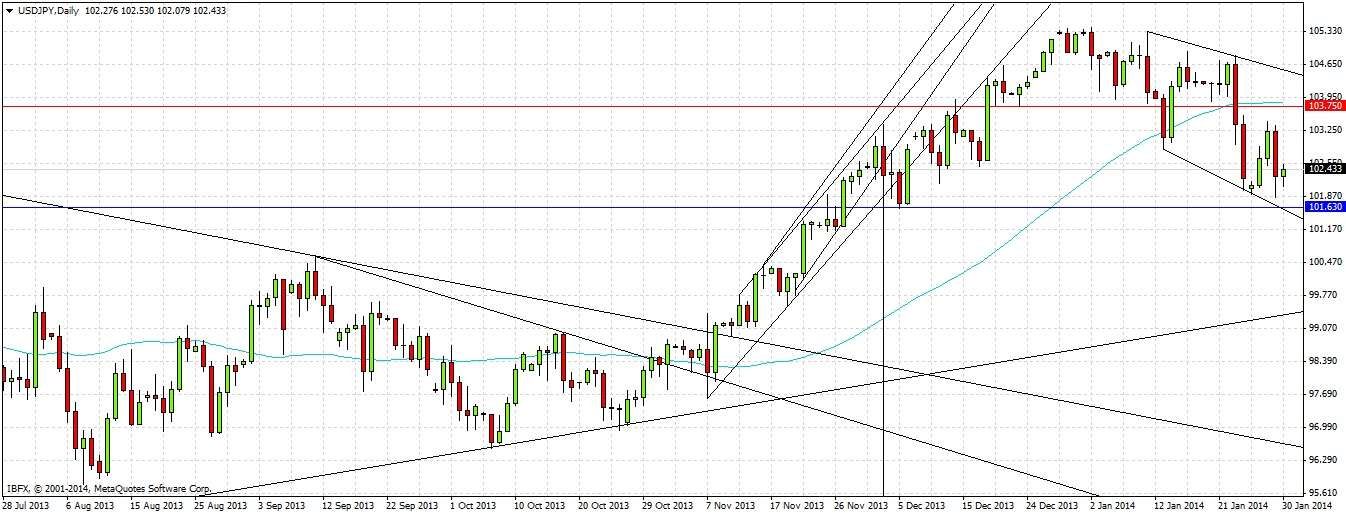

Following the recent multi-month uptrend, we are now beginning to be established in a bearish channel, although there is a very long-term bullish trend line below us, as can be seen in the daily chart below:

Therefore the picture is a little conflicted and I am looking for both long and short trades.

This pair fell somewhat yesterday, but the essential technical picture is unchanged. The likely support at 101.63 is now confluent with the lower channel trend line, so it should still prove to be supportive if reached. Above us is likely support turned to resistance at around 103.75:

There is no important news due today for the JPY. Concerning the USD, there is Advance GDP and Unemployment Claims at 1:30pm London time and then later Pending Home Sales at 3pm.