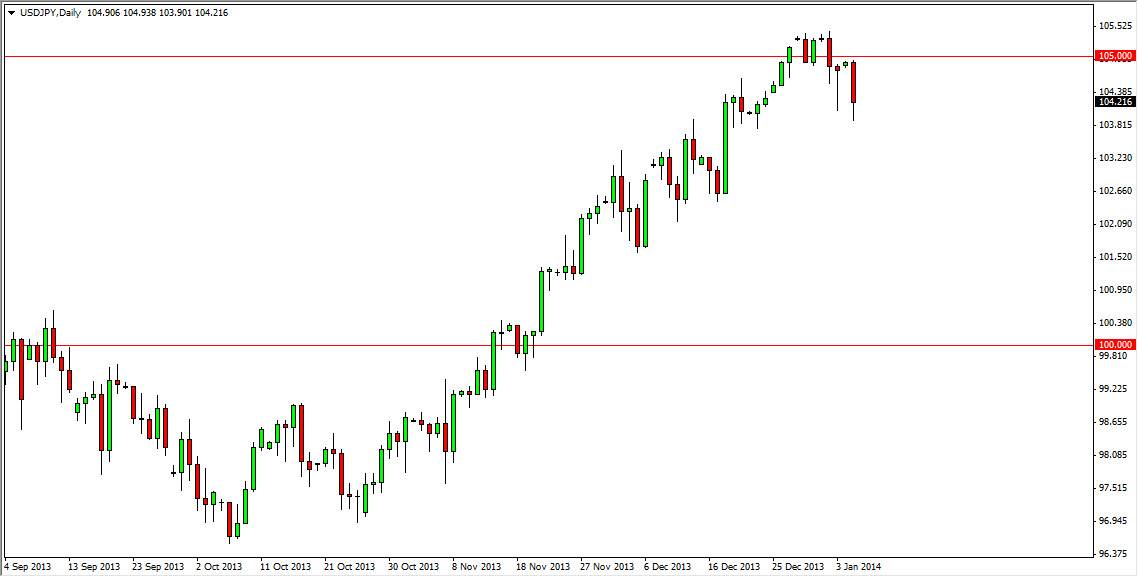

The USD/JPY pair fell during the bulk of the session on Monday, testing the 104 level. This area has been supportive in the past, so it makes sense that we would see a little bit of a bounce from it at the end of the session. On top of that, 105 level just above is significantly resistive and important, so at the end of the day it’s not a surprise that we couldn’t break down significantly.

The pair of course will continue to be bullish overall, but as the nonfarm payroll number comes out relatively soon, it’s likely that this pair will go sideways in the meantime. I am ultimately very bullish at the moment, and as a result I am more than willing to buy this pair every time we see signs of support going forward. I believe that this pair will be one of the better trades of the year going forward.

The different stance of both central banks.

The different stance of both central banks a significant. The Federal Reserve of course has started to taper off of quantitative easing recently, so that of course gives a little bit of a bid to the US dollar. Granted, they suggested that interest rates will remain low for a longer period of time than originally thought, but at the end of the day the United States is certainly much closer to pulling back from quantitative easing significantly than the Bank of Japan.

Speaking of the Bank of Japan, they have started to ease even more, and it’s likely that the central bank will continue to ease its monetary policy, driving down the value of the Yen, which of course is one of its goals. Japan is an export driven economy, so it’s very likely that will be the policy for the foreseeable future. If the jobs number comes out strong, that will give the Federal Reserve even more leverage to think about tapering, and that will drive this pair higher. Over the longer term, I am buying pullbacks in show signs of support as I really like this pair for a long term “buy and hold” type of marketplace.