GBP/USD Signal Update

Yesterday’s signals were not triggered and expired. The price did reach to within about 10 pips of our long trade before making our first profit target at 1.6390, but unfortunately it did not come down quite far enough to get us in to what would have been a profitable trade. The price also hit 1.6396 but broke through it comfortably, invalidating the level.

Today’s GBP/USD Signals

Risk 0.50%.

Entry should be made between 8am and 5pm London time today only.

Long Trade 1

Enter long at a touch of 1.6235 with a stop loss at 1.6194. Move the stop to break even at a reward to risk of 1:1 and take 50% of the trade as profit, leaving the remainder to ride.

Short Trade 1

Enter short at the next bar break of an hourly pin bar or engulfing bar rejecting and closing below the resistance level of 1.6475. If this level is not touched and rejected by the same hourly bar, or if an hourly bar closes more than a few pips above this level, the trade is immediately invalidated and should not be taken.

Stop loss 1 pip below the local swing high.

Take profit on 75% of the position at 1.6436, move the stop loss to break even and let the remainder run.

GBP/USD Analysis

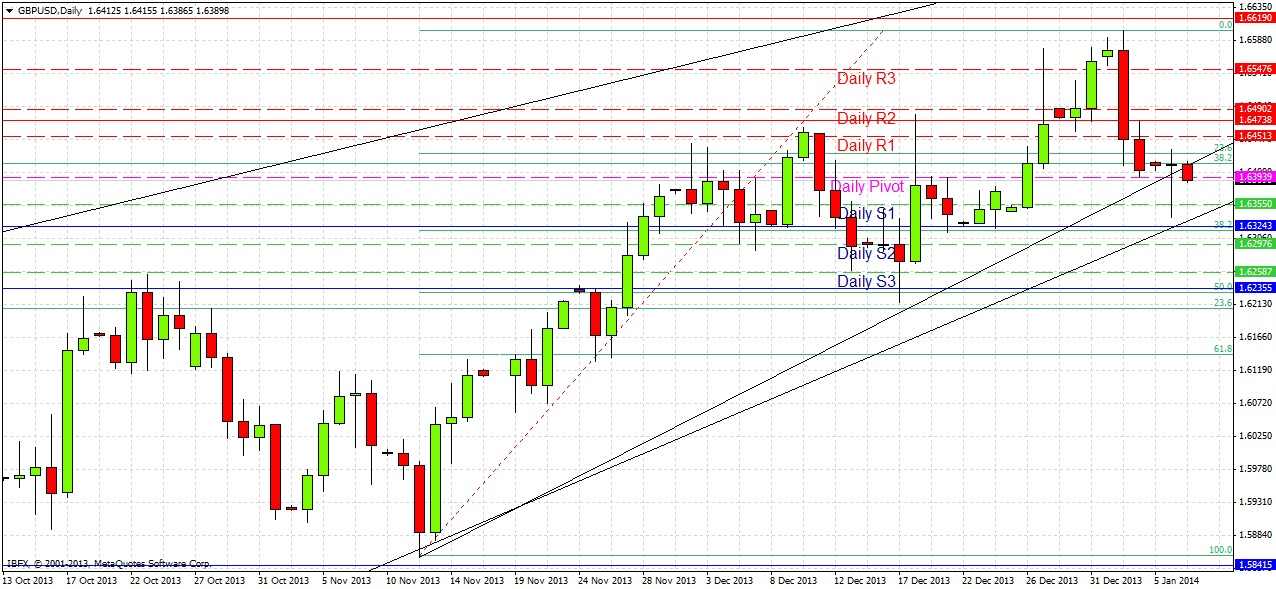

The price rose fairly strongly yesterday a little beyond 1.6400, producing a pin bar on the hourly chart towards the end of the London session that rejected two Fibonacci retracement levels. However we have not had much of a move down overnight so it not clear now what the next move will be, although the daily chart certainly suggests a move up as we printed a bullish pin bar opening and closing in its top quartile rejecting a bullish trend line:

I am not convinced by the pin bar as the action within it on the shorter time frames was not very strongly bullish. However it would be possible to enter a long trade if yesterday’s high is broken early in today’s London session with some momentum, although I am not recommending this as a signal.

Yesterday’s low was close to the support level of 1.6325, this is why I am not giving it as a signal for a long trade today, as it may have been exhausted already – time will tell.

There is a good support level below at 1.6235 which is confluent with a significant 50% Fibonacci retrace of the move up since November. As it is a long way away from the current price, I am giving it as a long touch trade signal.

The resistance level at 1.6475 could be good for a short but only if it is supported by price action, as if we rise up there today it could generate a lot of bullish momentum due to the pin bar on the daily chart.

There is important news today for the USD at 1:30pm (Trade Balance) but nothing for GBP so the pair might be quiet this morning, though could be affected by EUR news due at 10am London time.

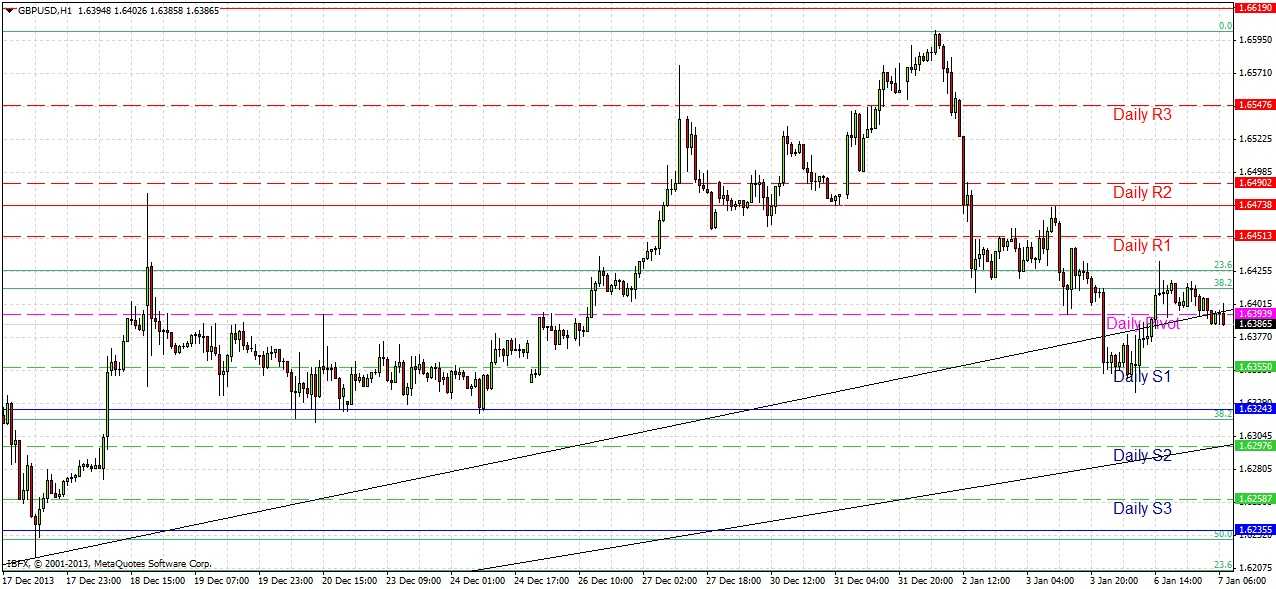

A shorter-term technical chart is shown below; I am not paying very much attention to the trend lines and have no real bias: