GBP/USD Signal Update

Yesterday’s signals were not triggered and expired.

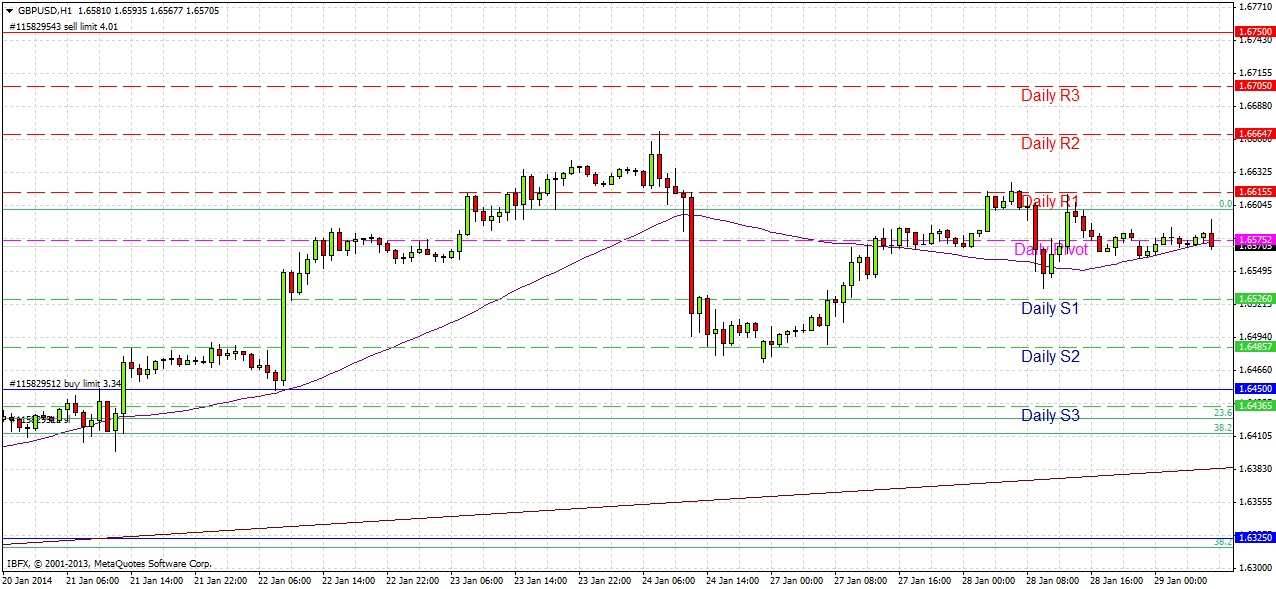

Today’s GBP/USD Signal

Risk 0.50%.

Entry should be made between 8am and 8pm London time today only.

If you are in an open and profitable trade at 6:30pm London time, take most of the position as profit and move the stop to break even, and be prepared to be slipped on the stop.

Long Trade 1

Enter long with a stop buy order at a next bar break of an hourly pin or engulfing bar after a first touch and rejection of 1.6450. The trade is invalidated once an hourly bar closes below this level.

Stop loss at the local swing low.

Move the stop loss to break even when the trade is 25 pips in profit and let it run.

Short Trade 1

Enter short with a stop sell order at a next bar break of an hourly pin or engulfing bar after a first touch and rejection of 1.6750. The trade is invalidated once an hourly bar closes above this level.

Stop loss at the local swing high.

Move the stop loss to break even when the trade is 25 pips in profit and let it run.

GBP/USD Analysis

There has been no change in the technical picture. Yesterday was quiet and indecisive. The overall bias should still be long as we are still established in a narrowing bullish channel that has been intact since last summer. There are no obviously good resistance levels above us except for a minor flip that occurred the last time the price was around 1.6750 in 2011. We are still a typical day’s range from either of the levels but there are no good levels visible before these.

There is important news due today for the GBP at 12:15pm London time (Governor of the Bank of England speaking) and also later on for the USD at 7pm (US FOMC statement).