By: Tradehits.com

What we’ve seen…

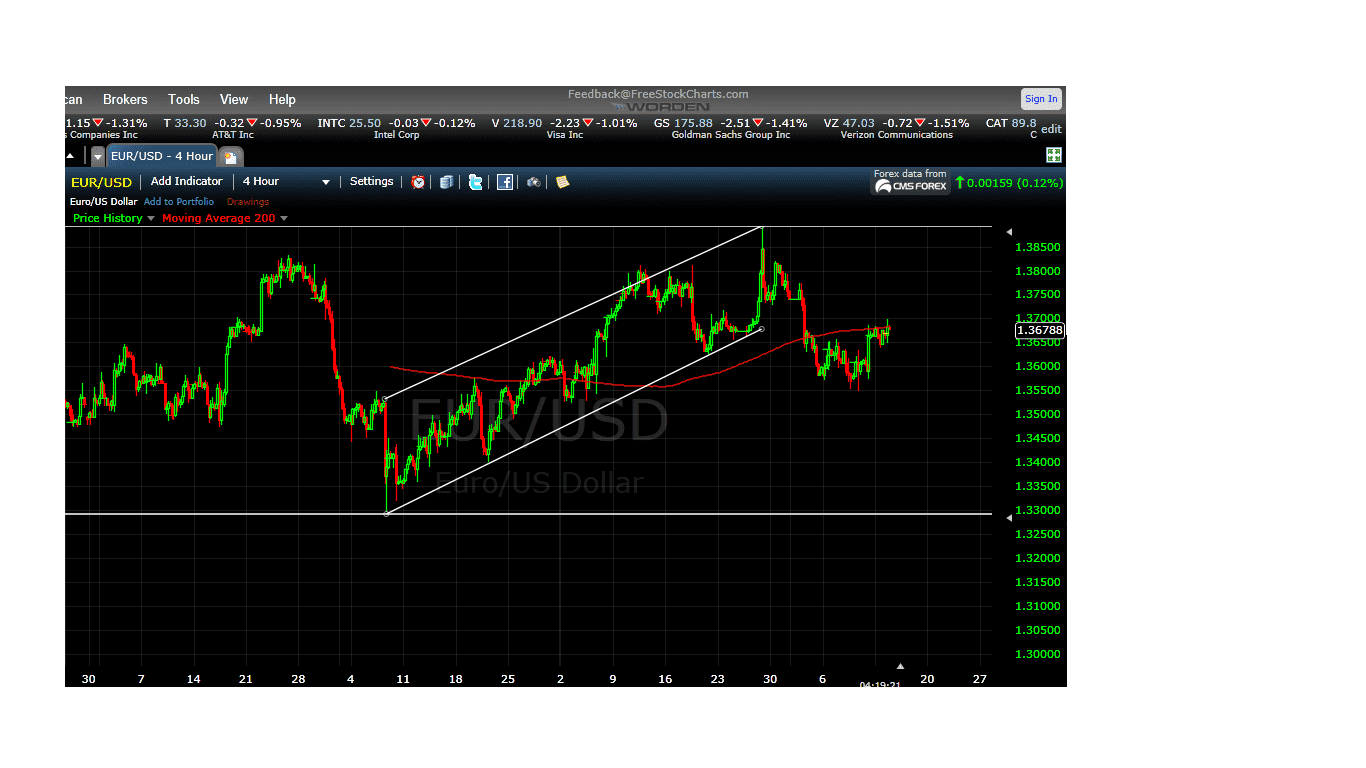

EUR/USD has started the new week quietly, after some strong gains late last week. The pair has jumped close to a cent since Wednesday, as it trades in the mid-1.36 range in Monday’s European session. On Friday, Non-Farm Payrolls slumped to an eighteen-month low, but the Unemployment Rate improved sharply. It’s a very quiet start to the week, with just two releases on the schedule. In the Eurozone, Italian Industrial Production dropped to 0.3%, missing the estimate. The sole US release is the Federal Budget Balance.

What to expect…

There is no change in EUR/USD's outlook. Recovery from 1.3547 could extend higher but considering bearish divergence condition in daily MACD, the rise from 1.2755 might be completed at already. We'd expect strong resistance below 1.3892 to limit upside and bring another fall. Below 1.3547 will target 38.2% retracement of 1.2755 to 1.3892 at 1.3458 first.

In the bigger picture, overall price actions from 1.6039 is viewed as a corrective pattern which is still in progress. Current development indicates that the choppy rise from 1.2042 is also still in progress. Such rise could now extend to 100% projection of 1.2042 to 1.3710 from 1.2755 at 1.4423. But we'll be cautious on strong resistance below the long term falling trend line (now at around 1.45) to limit upside. Meanwhile, break of 1.3294 support is needed to be the first signal of medium term reversal or outlook will stay bullish.

This analysis was provided by TradeHits.