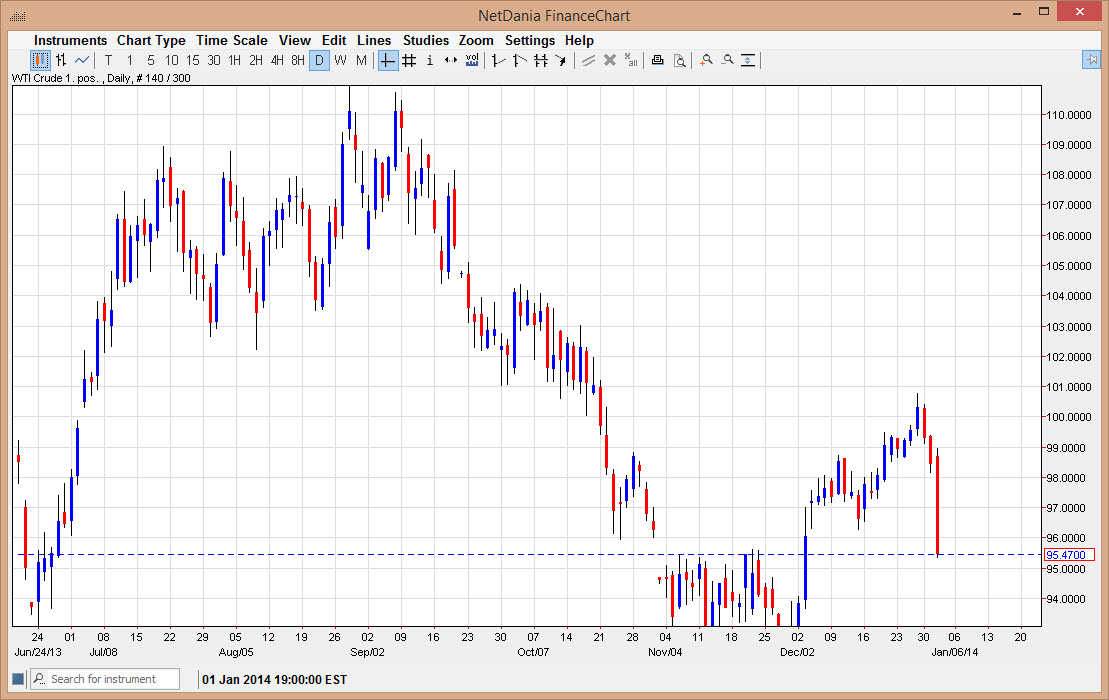

The WTI Crude Oil markets fell hard during the session on Thursday, reacting in part to the report that Libyan oil was about to go back online. This of course brings a lot more supply into the marketplace, and it should continue to drive prices a little bit lower in the meantime. However, reality sets in when you start to think about the lack of liquidity in this market. In the end, that probably exacerbated the move, and therefore I didn’t necessarily read too much into this ridiculously long candle.

One would have to believe that the markets are suddenly going to collapse based upon this news to believe this candle. I believe the fact that we are still in the holiday mode has a lot more to do with anything than that, and the fact that the $95 level below is so well supported from previous resistance keeps me on the sidelines.

Not convinced yet, waiting to see confirmation.

All things being equal, I think that the next several sessions in this market are going to be very illiquid. In fact, I don’t expect any real action until we get the nonfarm payroll number at the end of next week. With that being said, it’s very difficult to imagine a scenario that will have me involved in this marketplace in the near term. I do recognize that there is a significant amount of support below though, so a supportive candle would be enough to get involved I suppose, but I would probably keep my position somewhat small.

In fact, I believe that between now and the nonfarm payroll report, and its subsequent effect on this market, the best way to play this market is probably for the options market. Because of this, I will more than likely do most of my trading in the NADEX, as it allows short-term options to be played in this market. Those of you with access the binary options brokers may find that the best route to trade this market over the course of the next week or so.