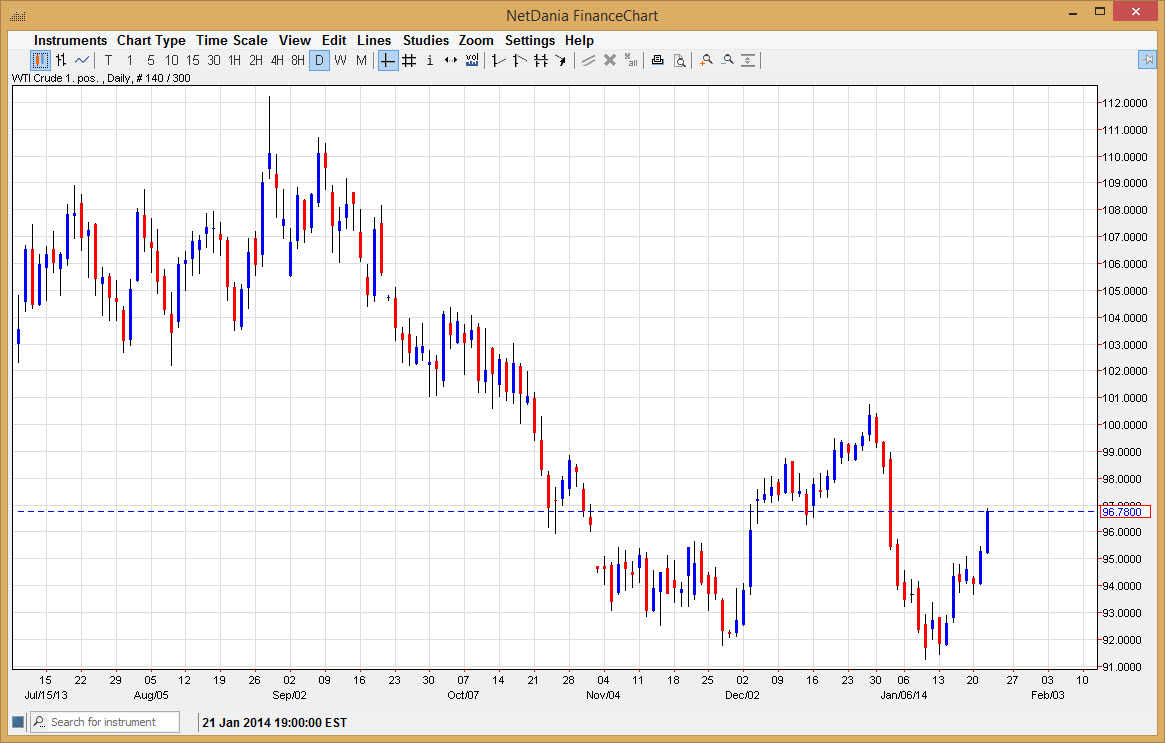

The WTI Crude Oil markets had a very strong showing on Wednesday, finally breaking above the $96 level, an area that I have five to be somewhat resistive. Now that we have closed above that area, I believe this market continues to go much higher, possibly to the $100 level although there is a lot of noise between here and there. The fact is that the $96 level was broken significantly, so the buyers out there will more than likely be attracted to this market.

Any pullback at this point in time will be looked at with suspicion by short-term traders, and they will more than likely be the driving force behind the uptrend that has certainly accelerated at this point in time. That being said, headlines continue to drive this market and therefore we could have choppy conditions. This is why I believe the short-term traders are going to come out ahead as opposed to the longer-term traders looking for steady moves.

Energy all around did well during the session.

The energy markets around the world did fairly well during the session on Wednesday, as the WTI market, the Brent market, and certainly the Natural Gas markets all rose drastically. With that being the case, it appears that energy itself is being bought up, and that should have a little bit of a “knock on” in fact to this market.

Although $95 didn’t really act as much resistance, I would expect it to be somewhat supportive, based upon the large, round, psychologically significant number. You can see that there were about three days’ worth of resistance, and as a result I think that will be enough to keep the market afloat.

The real question is whether not $100 can be broken. If he gets broken, this market really could take off to the upside, but it will take some type of significant market moving event to get above it. However, I believe in the short-term we will more than likely be able to buy this market on an almost daily basis as short-term traders continue to thrive.