By: Richard Cox

Into the end of 2013, financial markets were broadly influenced by widespread weakness in the US Dollar. A significant portion of these Dollar declines were driven by changing central bank expectations as the US Federal Reserve delayed its plans to start making monthly reductions in quantitative easing stimulus. These cuts did eventually come to fruition, however, and the Fed extended these plans at its latest meeting, as well -- reducing monetary stimulus injections by another $10 billion at its January meeting.

This is ultimately positive for the US Dollar. But we have not seen any bearish impact on gold, and it is important to look at some of the reasons for why this might be the case. The possible reasons here are important, and will help to determine whether or not the broader trends in the US Dollar (and in gold itself) will be sustainable into the latter parts of the year. It is also important to be reminded of the market correlations that are seen in areas like stocks, commodities, and in currencies. These correlations will provide important clues for market outcomes as these asset classes relate to one another.

Interconnected Market Relationships

The market’s first reaction to the Fed’s decision to cut monetary stimulus by another $10 could be seen in the central stock benchmarks -- especially in the S&P 500. Stocks have so far met selling pressure as the limitation of stimulus will likely lead to downside revisions in corporate earnings projections for the current quarter. The S&P 500 tends to show an inverse correlation with both the US Dollar and in gold, as investors react to changes in sentiment and risk aversion. So, these latest declines in the central stock benchmarks should contributing positive moves both to gold and the US Dollar as investors look for an alternative store of value.

But when we look at the closely interconnected relationships of all these asset classes, there are other factors at work as well. According to a commodities markets article by Tony Davis of Atlanta Gold and Coin Buyers, additional drivers in gold could be seen if there is not sufficient physical bullion to meet requests for delivery at some of the most heavily traded futures expiries. There is a strong possibility that this could be the case into the second half of this year, given the strong surge in gold buying that we have seen recently in emerging markets. China and India are now both in a close race to hold the position as the world’s largest importer of the precious metal, so there is not much reason to believe that these trends will be changing anytime soon.

Chart Perspective

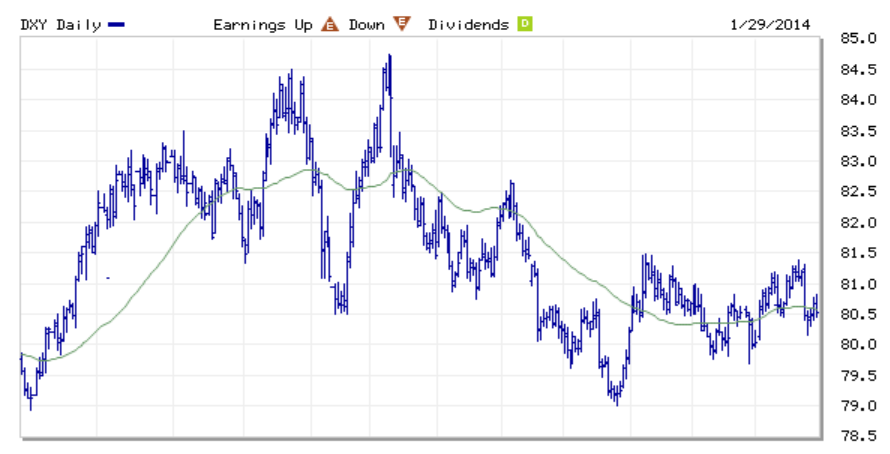

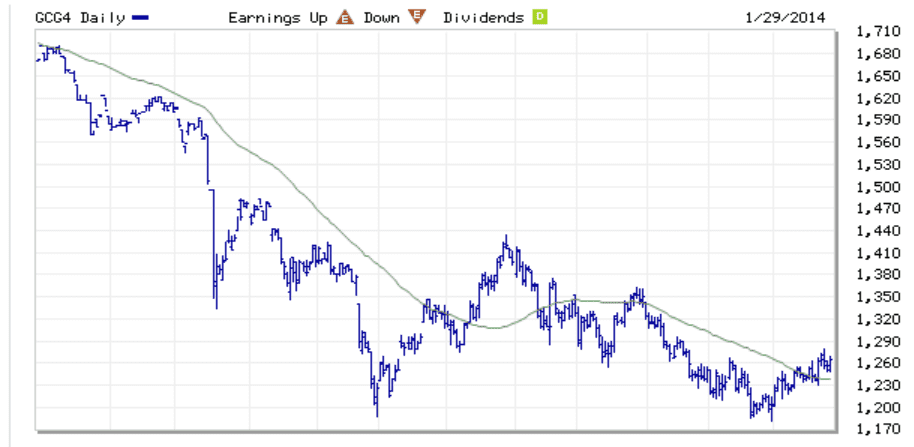

Commodities markets have already started to reverse some of the trends posted in the last few months. Some might suggest that positive trends in the US Dollar would have a negative impact on gold prices, but when the take the underlying fundamental scenario into consideration, this does not seem to necessarily be the case. Furthermore, chart analysis supports the prospects for both gold and the US Dollar, as both assets are starting to show evidence of a turning point in the longer term bearish trends.

The US Dollar is starting to stabilize at lower levels, making the greenback a suitable selection for contrarian buy positions at these cheaper valuations. Downtrend lines drawn on the shorter term time frames have already started to break to the upside, giving the indication that the cyclical bottom in the Dollar Index can now be found at 79. Bias is bullish as long as this area holds, a break of resistance at 81.5 confirms the call for new buys.

Gold is also starting to look much more encouraging on the shorter term time frames, with prices now pressuring resistance at 1,270. We have not seen any major declines from this area, however, an upside break here would call for a test of 1,380.